Distribution Center and Logistics Economic Incentive Landscape in 2020

by Kelley Rendziperis, on Nov 18, 2020 10:38:06 AM

Due to the outbreak of COVID-19, the global economy has suffered in 2020. From nationwide shutdowns to restrictions on cross-border travel, the pandemic has generally disrupted most economic sectors. However, as we discussed in our prior blog, Food & Beverage Manufacturing Economic Incentive Landscape in 2020, some industries continue to thrive; thus, we were interested in how the distribution center and logistics sector was performing amid this pandemic.

In 2020, the distribution center and logistics sector is expected to benefit from the increase in e-commerce activity as more goods are shipped across the globe.

In addition, the transformation of retail shopping over the last nine months and the closing of brick-and-mortar stores during the pandemic radically shifted even more consumers toward online shopping.

Of the top 25 largest warehouse and distribution center projects announced in 2020, five projects were for Amazon. The five Amazon projects will be located across four states, including Massachusetts, Delaware, Texas and two locations in Georgia. These projects are estimated to create 5,300 new jobs, with an investment of $1.13 billion and were offered $56.5 million in incentives.

United Parcel Service had three of the 25 top projects with planned expansions in Tennessee, Pennsylvania and North Carolina. These three projects are estimated to create 2,197 jobs, safeguard approximately 6,400 jobs and invest $1.87 billion. UPS was offered approximately $51.4 million in incentives.

FedEx also announced plans to expand its operations in Indianapolis with an investment of $1.6 billion, creation of 288 new jobs. FexEx was offered $4.4 million in incentives.

The following table identifies some of the largest economic incentive deals in the distribution center and logistics sector offered in the first three quarters of 2020. These projects provide a great way to benchmark the potential range of economic incentives for a variety of project types. However, it is important to understand these values are estimated and typically only reflect state level incentives.

| Company | Location | Capex ($M) | New Jobs | Retained Jobs | Economic Incentives Amount ($M) |

|---|---|---|---|---|---|

| United Parcel Service | Memphis, TN | $216.6 | 25 | - | $38.03 |

| Amazon | North Andover, MA | $400 | 1,500 | - | $27.00 |

| The DeLong Co. | Milwaukee, WI | $31.3 | - | - | $20.80 |

| Deutsche Post | Memphis, TN | $85.72 | 255 | - | $19.76 |

| Amazon | Stone Mountain, GA | $238 | 1,000 | - | $19.25 |

| Nestle | Clinton, IA | $140 | 73 | - | $9.60 |

| United Parcel Service | Multiple locations, PA | $1,400 | 1,721 | 6,458 | $8.96 |

| The Kroger Co. | Frederick, MD | $0 | 400 | - | $7.15 |

| Wal-Mart | Ridgeville, SC | $220 | 1,000 | - | $5.00 |

| The Kroger Co. | Multiple locations, OH | $100 | 15 | 600 | $4.70 |

| Amazon | Newport, DE | $250 | 1,000 | - | $4.50 |

| FedEx Corp. | Indianapolis, IN | $1,603 | 288 | - | $4.40 |

| United Parcel Service | Graham, NC | $262 | 451 | - | $4.40 |

| Argos Holdings | Kansas City, MO | $143 | 1,600 | - | $4.00 |

| Techtronic Industries | TN | $20 | 500 | - | $4.00 |

| Amazon | Pflugerville, TX | $250 | 1,000 | - | $3.80 |

| Deutsche Post | Memphis, TN | $20.75 | 105 | - | $2.36 |

| Amazon | Appling, GA | $0 | 800 | - | $2.00 |

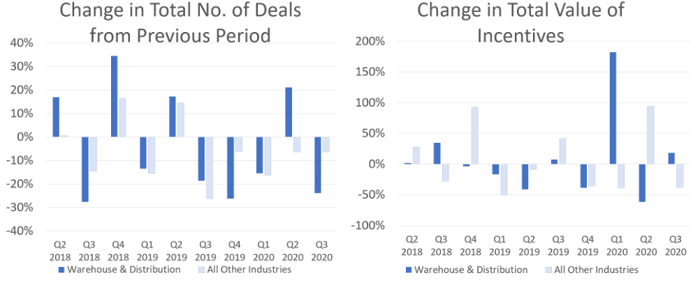

To illustrate the trends of the distribution center and logistics sector, the charts below demonstrate the economic incentives awarded in quarter intervals over the prior two years compared to all other industries in the economy:

Data Source: IncentivesFlow, a service from WAVETEQ Limited

Across all industries, there was a general decline in the number of economic incentive awards offered and a fluctuation in the value of these incentives. There were 1,448 projects for industries other than distribution center and logistics for the first three quarters of 2020 compared to 2,319 projects for the same period in 2019 and 2,632 in 2018. For the distribution center and logistics sector, there were 119 projects for the first three quarters of 2020 compared to 200 projects for the same period in 2019 and 196 during 2018. There was a remarkable increase in the value of economic incentive awards announced in the first quarter of 2020 resulting in a 182% increase over the previous quarter. The value of economic incentives offered grew from $45 million to $127 million, in the fourth quarter of 2019 to the first quarter of 2020 which was likely a result of the announced projects by UPS (two projects), Amazon and FedEx.

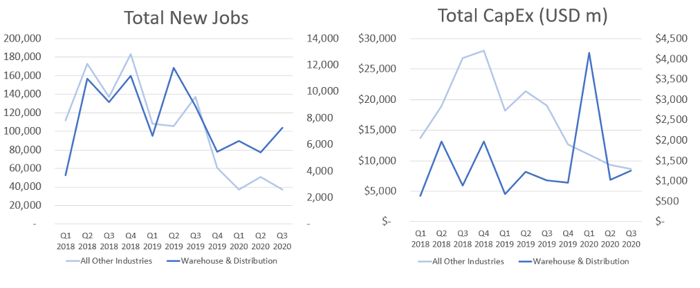

Data Source: IncentivesFlow, a service from WAVETEQ Limited

Where did these projects locate, which programs are most utilized and which states offered the most in incentives?

The table below depicts the top five programs that were offered to projects in the distribution center and logistics sector and the top five states where these projects located in the last three quarters:

| Incentive Program | Total No. of Deals |

|---|---|

| Indiana Economic Development for a Growing Economy (EDGE) | 12 |

| Kentucky Business Investment program | 12 |

| Ohio JobsOhio Economic Development Grant | 8 |

| Kentucky Small Business Tax Credit (KSBTC) | 6 |

| Michigan Small Business Relief Program | 6 |

Source: IncentivesFlow, a service from WAVETEQ Limited

A significant proportion of distribution center projects are in the Midwest. In the top five states alone, a total of 54 projects are locating in Kentucky, Indiana, Ohio and Michigan. These projects comprise nearly 50% of the 119 announced warehousing and distribution projects this year, through the third quarter.

| Destination State | Total No. of Deals | Incentive Amount ($M) |

|---|---|---|

| Kentucky | 18 | $12.5 |

| Indiana | 14 | $11.8 |

| Ohio | 13 | $8.06 |

| Michigan | 10 | $.51 |

| Pennsylvania | 6 | $11.4 |

Source: IncentivesFlow, a service from WAVETEQ Limited

The table below depicts the states that offered the largest award of incentives.

| Destination State | Total No. of Deals | Incentive Amount ($M) |

|---|---|---|

| Tennessee | 5 | $65.08 |

| Massachusetts | 4 | $30.19 |

| Georgia | 5 | $23.52 |

| Wisconsin | 1 | $20.8 |

| Kentucky | 18 | $12.5 |

Source: IncentivesFlow, a service from WAVETEQ Limited

Conclusion

We will continue to monitor the distribution center and logistics sector, as well as other industries and sectors, for overall trends, the impact of growth in e-commerce, the pandemic and the potential shift of global supply chains.

For additional information or questions, please contact Kelley Rendziperis at krendziperis@siteselectiongroup.com.

Blog contributions by Nancy O’Brien Ellis and Luciana Arteaga-Nemtala