Food & Beverage Manufacturing Economic Incentive Landscape in 2020

by Kelley Rendziperis & Cody Gibbs, on Aug 19, 2020 8:07:23 AM

Due to COVID-19, the first half of 2020 has been tumultuous for the entire global economy. As a wave of shutdowns and slowing consumer activity swept the nation during these last few months, only a handful of industries appeared relatively unscathed.

Traditionally, the overall food sector has been considered relatively “recession-proof.” Regardless of external factors, people will always need to eat, and so the demand for food will be unwavering and consistent. However, this trend is not infallible, as bars and restaurants were some of the earliest public spaces shut down by government mandates during the pandemic. While bars and restaurants continue to be some of the hardest hit segments of the economy, from an economic incentives perspective, the last six months were encouraging for the food and beverage manufacturing subsectors, especially when compared to the consolidated performance of all other industries during this time period.

Economic incentive awards to food and beverage manufacturing operations

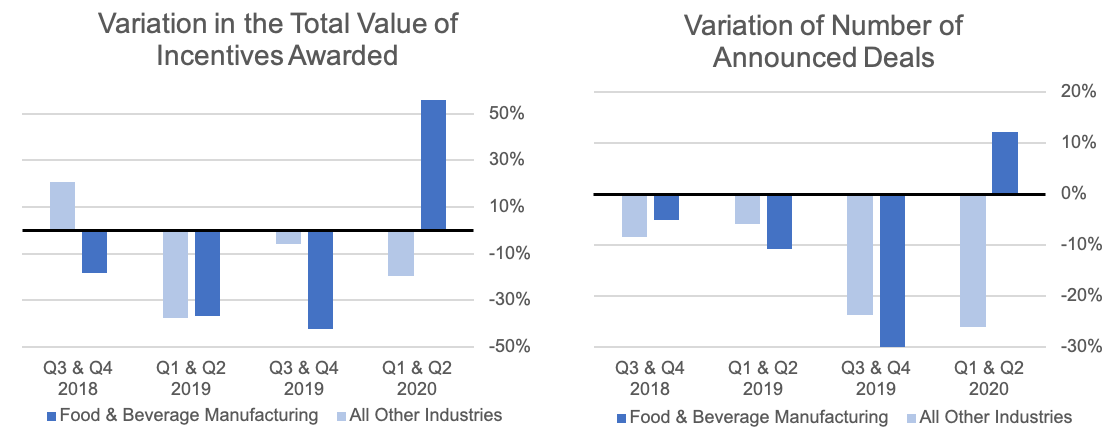

To illustrate the growth of the food and beverage manufacturing subsectors, the charts below demonstrate the economic incentives awarded in six-month intervals over the prior two years compared to all other industries of the economy:

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Data Source: IncentivesFlow, a service from WAVTEQ Limited

In general, there was a decline in the total value of announced economic incentives and the number of awards for all industries during the second half of 2018 through 2019. However, this trend reversed for food and beverage manufacturers during the last six months, with the number of projects rising from 82 in the last half of 2019 to 92 during the first half of 2020. Moreover, the value of announced economic incentives increased from $59 million to $92 million during the same time frame.

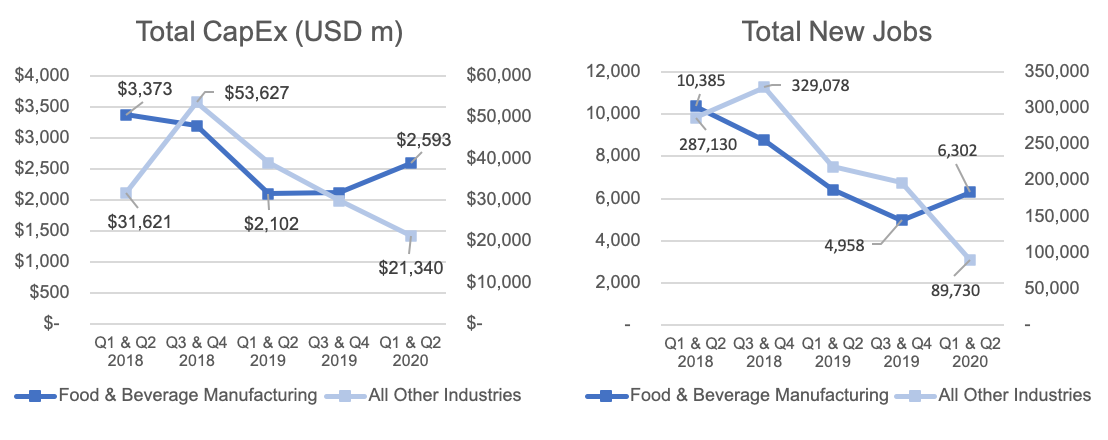

When evaluating other variables like capital expenditures and total new jobs, the last two quarters produced an overall increase for the food and beverage sectors while all other industries declined:

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Which states are benefiting most?

The following two tables show the top five states according to the total number of announced projects awarded economic incentives and the total value of economic incentives during the first six months of 2020 for the food and beverage manufacturing subsectors:

|

|

Of the states listed, Kentucky, North Carolina and Indiana appear on both tables. Some notable programs from these states include the Kentucky Business Investment and Enterprise Initiative Act, North Carolina Industrial Development Fund and Job Development Investment Grants, and the Indiana Economic Development for a Growing Economy.

Conclusion

The industries in the food and beverage manufacturing subsectors have remained strong throughout this pandemic. In fact, many of Site Selection Group’s current projects are in these industries. While this rapid growth is encouraging, one significant challenge is being able to adequately staff these expanded operations. The success and longevity of these new projects will likely depend on incentivizing the unemployed workforce to return to work. Site Selection Group will continue to monitor various trends across all industries.

For additional information or questions, please contact me at krendziperis@siteselectiongroup.com.