Call Centers Evaluate the Return on Investment of Permanent Work-From-Home

by King White, on Oct 21, 2020 8:49:49 AM

Companies are struggling to determine if they should shift their call centers permanently to work-from-home (WFH). The old saying “Is the juice worth the squeeze?” seems to be the common theme. I guess it really depends on your preferred juice. Is it customer satisfaction, employee retention, labor availability, risk mitigation or cost reduction? To help you evaluate the return on investment of a long-term WFH shift, Site Selection Group takes a look at some of the qualitative and quantitative factors that should go into your decision as well as a model to help you calculate the return on investment of your decisions.

Pros and cons of WFH

The most challenging issue with WFH is balancing the positive and negative factors of your decision. There are so many “what if” scenarios that need to be considered. For example, the impact of a single data security breach can have a massive financial impact on a company. The following table highlights some of the benefits and challenges of WFH.

| POSITIVES | NEGATIVES |

|

|

The return on investment may be much longer than expected

Executives immediately think that closing their facilities and shifting to WFH will yield huge savings. This is a bit of a misconception as real estate is typically less than 5% of a call center's overall operating cost. In addition, most companies typically have call center facility lease obligations that take time and capital to sublease especially during a recession. You need to be extremely careful to not “trip over dollar bills to pick up pennies.”

Another challenge can be agent productivity. There are many reports of both increased and decreased agent productivity. The long-term implications of the COVID WFH experiment have not been settled yet. What happens when employees can start living a normal life again and begin to slack on the job? If an agent loses one hour of productivity per week or 12 minutes per day due to various distractions, agent productivity is reduced by 2.5%.

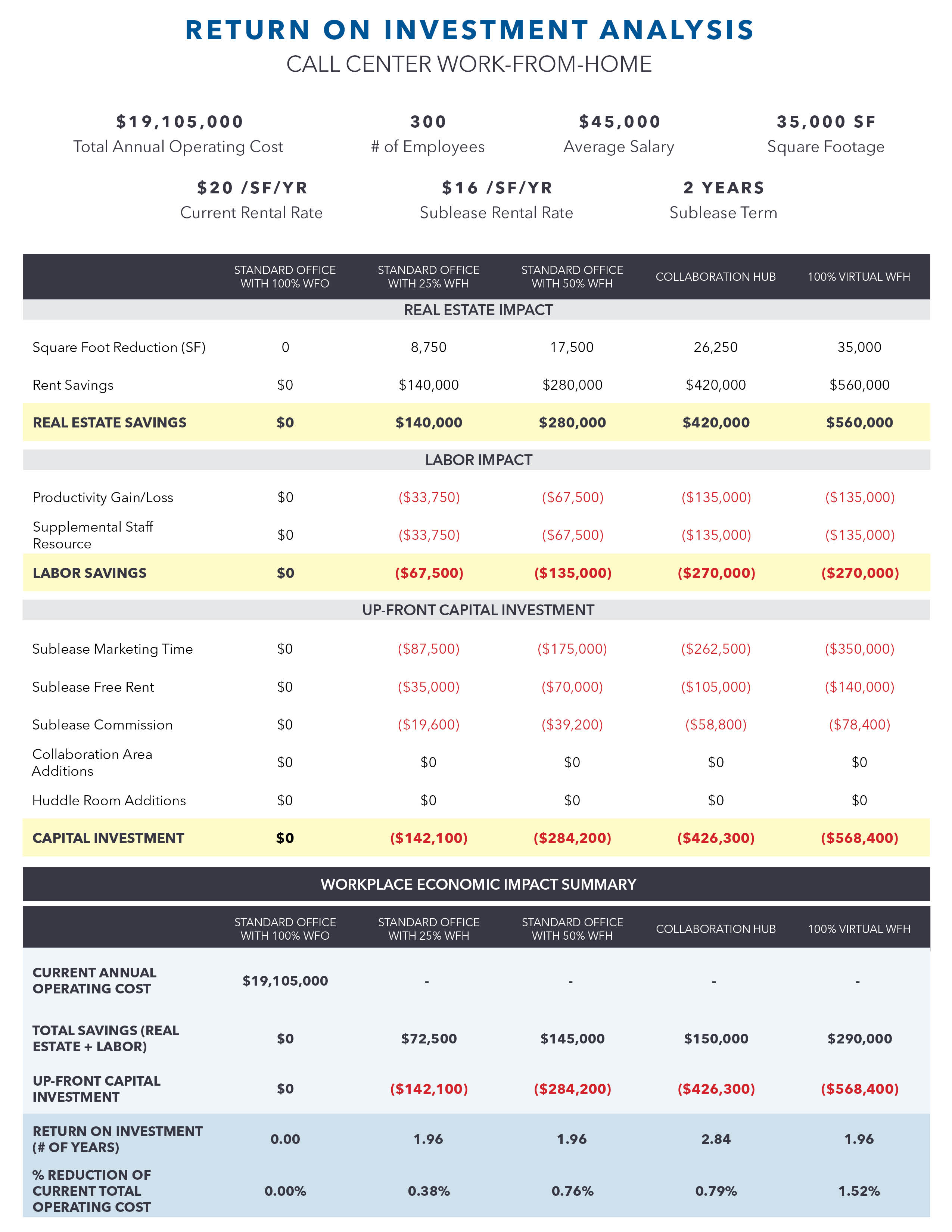

Site Selection Group has developed a cutting-edge analysis to help you evaluate the return on investment of WFH strategies. As you will see, the return on investment for the below 300-employee call center is approximately two years based on the assumptions outlined.

Conclusions

The success or failure of WFH will not be known for years. There is no doubt that there will be some significant challenges that surface such as data breaches or large-scale residential internet outages that could create chaos for WFH call center networks. Considering that the real estate cost savings may only be a few percentage points of your operating costs, you need to ask yourself, “Is the juice worth the squeeze?” before you make any long-term decisions. A wait-and-see approach might be the most strategic option. To learn more about calculating your return on investment, you can download our recent whitepaper: Calculating the Return on Investment of Work-From-Home Workplace Strategies.