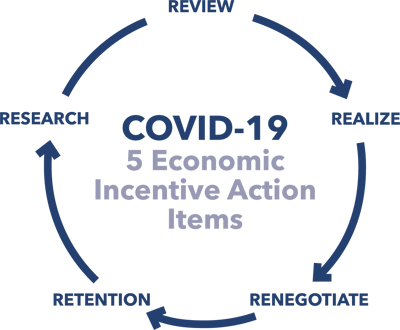

5 Actions to Preserve Economic Incentives in Light of COVID-19 (follow-up)

by Kelley Rendziperis, on Sep 23, 2020 9:47:47 AM

As a follow-up to our blog in May discussing the impact of COVID-19 on economic incentives, Site Selection Group wanted to provide an updated version reiterating what steps every company should take to preserve and maximize economic incentive portfolios.

1. REVIEW

The first thing all businesses should do is evaluate their economic incentive portfolios. An incentive management system like IncenTrak® which houses all the necessary economic incentive agreements, project commitments and receivables makes this an easy process; however, most companies use Excel worksheets to track their benefits and a review of existing agreements may be necessary. Site Selection Group recommends a company collect current data regarding capital investment, job creation and wage targets for projects which have garnered incentives to determine progress toward meeting commitments within the time frame required. Depending on the magnitude of benefits, this could also assist key stakeholders in making prospective business decisions regarding retention, expansion or consolidation plans.

2. REALIZE

Do not let compliance fall behind. Continuing to file timely submissions and realize incentives remains important during this time for a couple reasons. First, failure to timely submit compliance may cause a company to forfeit their benefits. Many jurisdictions have extended filing due dates for income tax returns, sales tax returns and property tax renditions. However, if there has not been an express extension of time to file, a company should either formally request an extension or plan to timely file the necessary documents. Second, with state and local communities becoming increasingly cash strapped, timely submission of compliance documentation may reduce the risk of not getting paid if a community runs out of funds or places programs on hold.

For a refresher on how to identify critical terms within an Economic Development Agreement or Memorandum of Understanding, as well as how to implement an effective compliance process please refer to my prior blog Establishing an Effective Economic Incentive Compliance Process.

3. RENEGOTIATE

Everyone understands that COVID-19 is wreaking havoc on many businesses. Communicating your struggles as early as possible is important to keep jurisdictions appraised of any changes that may be requested. While it may be too early to determine exactly how your business will be impacted or how soon you can reevaluate and recommit to revised investment and headcount projections, incorporating economic development officials in those conversations will help them be better suited to assist in renegotiating existing awards as necessary.

In addition to reviewing existing plans, if your operations have changed due to the pandemic and based on a need to assist the general public, such as converting operations to make personal protective equipment, ventilators, etc., then it is important to determine if existing awards can be altered to reward such activities.

4. RETENTION

Communities remain focused on retaining their existing workforce. Jurisdictions with pre-existing retention programs are better positioned to financially assist companies to incentivize job retention. COVID-19 is perhaps the most extreme example of what should qualify as extenuating circumstances justifying a request for financial assistance to maintain operations. Companies should investigate whether these programs already exist or whether they can add value in helping shape new retention programs alongside economic development officials. Preserving existing business operations is a vital component to business attraction efforts and should be a priority for economic developers.

5. RESEARCH

Some states are trying to jump back into “normal” as quickly as feasible, while others are much more conservative in their approach. Based on the differing reactions across the United States and even within each state’s borders, the lack of uniformity makes it difficult to know what economic incentive programs may exist to address issues caused by COVID-19. Site Selection Group recommends continually researching state and local policies to determine if there are new or retention incentives available for your operations, as well as changes to existing programs. A few recent examples include the North Carolina Job Development Investment Grant program and the New York Excelsior Program which allow the deferment of project commitments for a year if a request is proactively made.

Conclusion

Taking a proactive approach with your economic incentive portfolio may help avoid losing out on incentive receivables. It is also important not to assume that programs and policies are the same. Things will inevitably change moving forward and having a working, productive relationship with your state and local economic development officials is critical. Site Selection Group is here to assist you with reviewing economic incentive agreements and interfacing with governmental officials as needed.

For additional information or questions, please contact me at krendziperis@siteselectiongroup.com.