2022 Mid-Year State Tax and Economic Incentive Program Updates

by Kelley Rendziperis, on Jul 25, 2022 10:25:57 AM

As we head into the second half of the year, states are reviewing their tax structure and economic incentive programs to remain competitive. Some states developed creative incentives to equitably award large projects stemming from megaprojects, while others have tweaked existing tax laws and/or incentive programs to make them more impactful to companies overall. The summary below captures a variety of updates spread throughout the United States.

Megaproject Economic Incentives

Every jurisdiction is eager to win the next mega project for several obvious reasons. One important reason is that communities realize that the spinoff effects of such projects are equally transformative. Suppliers are known to relocate near their customers and sometimes are required to do so to maintain their business relationships.

From an economic incentive perspective, it is common that the largest incentives are awarded to the companies who commit to a jurisdiction first. The reason for this is because it is difficult for trailing suppliers and third-party vendors to attest that “but-for” an award of economic incentives they would not locate within the jurisdiction. While this may be accurate, it undervalues the economic impact of these tangential investments.

However, where does a community draw the line in offering incentives? Do they only offer incentives to a set number of the new suppliers or only to new projects announced within a certain time frame? Ohio and Kansas have undertaken the task of standardizing economic incentives for megaprojects and their suppliers due to their recent wins of Intel and Panasonic, respectively.

Ohio

In addition to the billions of dollars offered to Intel, the following summarizes the megaproject tax incentives Ohio will offer certain suppliers of a megaproject:

- Job Creation Tax Credit (JCTC) term lengthened the maximum term of the refundable credit from the current 15 years to 30 years

- Assignment of all or a portion of the megaproject supplier’s JCTC to the megaproject’s operator

- Commercial Activity Tax (CAT) exclusion of gross receipts of a megaproject supplier from sales to a megaproject operator

- Lengthening the maximum term of local community reinvestment area or enterprise zone property tax exemptions to 30 years

To qualify for these incentives a business must either operate a megaproject or sell tangible personal property to one. A megaproject is a development project that satisfies all the following conditions:

- The operator must compensate the project’s employees at 300% of the federal minimum wage or more

- The operator must either make at least $1 billion in fixed-asset investments in the project or create at the project at least $75 million in annual Ohio employee payroll

- If the project qualifies based on Ohio employee payroll, the operator must maintain at least $75 million in annual payroll at the project throughout the term of the JCTC

- The project requires “unique sites, extremely robust utility service, and a technically skilled workforce.”

Suppliers of megaprojects are eligible for the incentives if they make at least $100 million in fixed-asset investments in Ohio and create at least $10 million in annual Ohio employee payroll and maintain that level of payroll throughout the term of the JCTC as a qualifying megaproject supplier.

Kansas

Kansas Senate Bill 347, Attracting Powerful Economic Expansion (APEX), awards companies within targeted industries (manufacturing, aerospace, logistics/distribution, food and agriculture, professional services, and headquarters) that invest at least $1 billion in Kansas. Qualifying firms are eligible for the following:

- Refundable investment tax credits up to 15% of qualifying capital investment

- Partial rebate of payroll up to 10% per year; not to exceed 10 years

- Training reimbursement up to 50% of qualifying expenses, not to exceed $5 million annually; $25 million total

- Relocation reimbursement up to 50% for non-Kansas residents; limited to $1 million annually, $10 million total

- 100% sales tax exemption up front for materials to construct facility

In addition to a megaproject, five qualifying suppliers are eligible for the following benefits:

- Refundable investment tax credits, scaled, up to 10% of the first $100 million of qualifying capital investment

- Partial rebate of payroll withholding tax up to 65% per year; not to exceed 10 years

- Training reimbursement up to 50% of qualifying expenses, not to exceed $250,000 annually $1.25 million total

- 100% sales tax exemption up front for materials to construct facility

This legislation was clearly targeted to win Panasonic’s $4 billion electric vehicle battery manufacturing facility, as can be seen from the fact the APEX program only allows for one qualifying firm to be approved in each calendar year, limits benefits to five suppliers, and the program sunsets on December 31, 2023. In addition, APEX incentives for a qualifying firm or supplier, which must be approved by the State Finance Council, are mutually exclusive with other statutory programs such as the Promoting Employment Across Kansas program (PEAK), Kansas Industrial Training (KIT), and the High-Performance Incentive Program (HPIP).

Apportionment State Updates

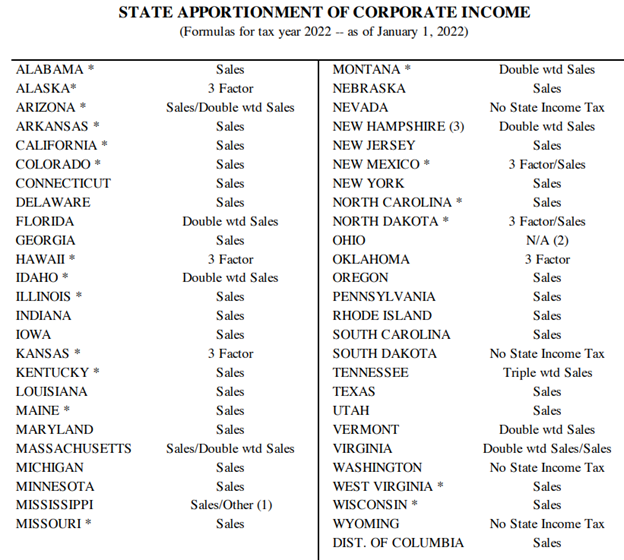

A multistate corporation is required to distribute its income, for state corporate income tax purposes, among the states in which it does business. This process is known as “apportionment” of business income. States generally apportion income in three primary ways:

- An equally weighted three-factor formula consisting of property, payroll, and sales

- A three-factor formula with a more heavily weighted sales factor

- A single sales factor

While the traditional model for apportionment was the three-factor formula, most states have now adopted a single sales factor. The rationale for this was based on the premise that apportioning income to a state based on property and payroll was akin to penalizing a company for investing capital and employing residents within a state’s boundaries.

The chart below shows state apportionment formulas for 2022, as reported as of January 1, 2022:

Source: Federation of Tax Administrators – January 2022

Source: Federation of Tax Administrators – January 2022

Some of the more recent transitions in state apportionment formulas to a single sales factor effective for tax years beginning on or after January 1, 2021, are Alabama and Arkansas. For tax years beginning on or after January 1, 2022, Idaho, Maryland and West Virginia shifted to a single sales factor formula. New Hampshire adopted a single sales factor beginning on or after December 31, 2022, and Vermont will have a single sales factor apportionment formula beginning on or after January 1, 2023.

Often a single sales factor methodology is more favorable to multistate corporations who export their products or services from the state in which they have a physical presence; thereby reducing their state income tax liability. The consequence of such change is that it can also devalue existing and future income tax credits.

California

California Competes Tax Credit Application Periods for the fiscal year 2022/2023 have now been released:

- July 25, 2022, through August 15, 2022 ($85 million in tax credits available; $120 million in grants available)

- January 3, 2023, through January 23, 2023 ($120 million in tax credits available); and

- March 6, 2023, through March 20, 2023 ($99.7 million plus any remaining unallocated amounts from the previous application periods)

Notably, California is allowing another grant allocation similar to the one released at the beginning of 2022. According to statute, eligible applicants for the grant program must meet at least one of the following criteria:

- The applicant will create at least 500 new, full-time jobs in the state, determined on the basis of an annual full-time equivalent

- The applicant will make a significant infrastructure investment, defined as a project requiring construction or renovation expenditures of at least $10 million over no more than five years, in California

- The applicant will create jobs or make investments in a high-poverty area or high-unemployment area in California.

Additional background, eligibility, and application details can be found online at https://static.business.ca.gov/wp-content/uploads/2022/07/CalCompetes-Grant-Solicitation-FY-2022-23.pdf

In addition to the APEX program described above for megaprojects, Kansas made other program adjustments as well.

Kansas

High-Performance Incentive Program

The Kansas High-Performance Incentive Program (HPIP) yields several benefits, including:

- Investment credit: 10% corporate income tax credit on qualified capital investments

- Employee training credit: dollar for dollar corporate income tax credit up to $50,000 for training and education expenditures that exceed 2% of total payroll at the worksite

- Sales tax exemption for purchases of materials and services

To qualify, a company must be either a manufacturer or able to document that most of its sales are to Kansas manufacturers and/or out-of-state businesses or government agencies and pay above-average wages.

In 2021, Senate Bill 65 removed the requirement to participate in the Kansas Industrial Training or Retraining program to qualify. Moreover, projects placed in service after January 1, 2021, are allowed to sell or transfer up to 50% of HPIP tax credits. A taxpayer can sell or transfer credits within a single tax year and may request up to two transfers within that year.

The remote workforce in Kansas

Kansas is being flexible in allowing remote workers to qualify for incentive programs. An employee must pay withholding to the state, be included on Department of Labor reports, and be listed on the facility’s payroll. Permanent full-time or part-time employees working a minimum of 20 hours per week and offered adequate health insurance where 50% of the premium is covered by the company are eligible. The facility must be solely leased or owned by the company.

South Carolina

The Comprehensive Tax Cut Act of 2022 was passed by South Carolina on June 15, 2022, and includes the following benefits:

- Tax rate reduction: The Act lowered the top marginal individual income tax rate to 5.7% in 2022. This adjustment is likely necessary to remain competitive with neighboring states like George and North Carolina which have reduced state income tax rates to 4.99%. North Carolina’s rate is set to further drop to 3.99% in 2026.

- Manufacturing property tax exemption: South Carolina’s manufacturing property tax assessment ratio is 10.5%. The Act provides for an exemption of 42.8571% of the value, which equates to effectively lowering the 10.5% manufacturing assessment ratio to 6%. Since South Carolina has a relatively high effective property tax rate, this exemption is very impactful to manufacturers and is also incremental to the current five-year statutory manufacturing abatement. Notably, local governments will be reimbursed for the exemption.

A primary economic incentive tool in South Carlina is a fee-in-lieu-of-tax (FILOT) which reduces the 10.5% assessment ratio to 6%. Thus, this new exemption negates the need for a FILOT in the short term; however, a FILOT reduces the assessment ratio for an extended term, e.g., 30 years or 40 years, locks in the millage rate and may also include special source revenue credits against FILOT payments. It will be interesting to see how manufacturers with new projects will value the exemption versus the FILOT, as they are mutually exclusive, since the exemption may be more impactful in earlier years.

Conclusion

States continue to be creative in trying to win and incentivize megaprojects, while also trying to reduce overall state tax burdens. Thus, it is important to continually monitor legislative updates, especially when looking at locations for new or expansion projects.

For additional information about these updates or programs, please contact me at krendziperis@siteselectiongroup.com with any questions.