U.S. Site Selection Profile: Photovoltaic Manufacturing

by Josh Bays, on Feb 12, 2024 8:00:00 AM

Because of the green initiatives in the Inflation Reduction Act, photovoltaic manufacturing in the United States is currently as active as any industrial sector. Historically, the photovoltaic supply chain has been deeply rooted in Asia due to more favorable cost structures and supply chain clustering.

Site Selection Group, a full-service location advisory, real estate and economic incentives services firm has been extremely active in the photovoltaic industry, siting projects in both the downstream and upstream phases of the value chain. At the risk of oversimplifying this value chain, the graphic below summarizes the major components of the photovoltaic manufacturing sector (or at least how we think about it in terms of site selection).

Note: SSG co-classifies “ingots” and “wafers” together, but some companies have announced plans to separate these functions. Similarly, it’s common for companies to co-locate functions (e.g. ingot and wafers with solar cells or solar cells with module assembly).

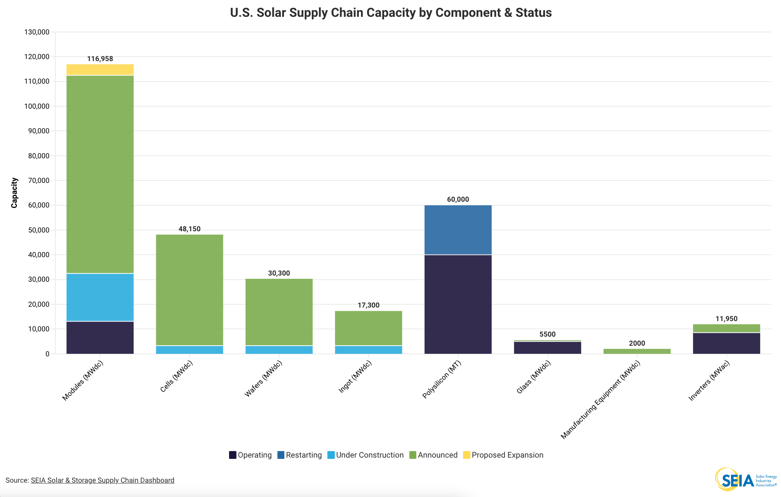

Because China currently dominates polysilicon production, and materially expanding those capabilities in the United States can be problematic from a cost and energy perspective, most photovoltaic manufacturing investment in the United States has been downstream in the value chain. This is shown in the following chart produced by the Solar Energy Industries Association.

The current production profile is concentrated in a few key states

The map below shows the current location of producing photovoltaic manufacturing plants. Despite a massive wave of announcements and upstream capacity coming online, the overwhelming majority of the operating facilities are downstream module assembly plants. With a few exceptions, specifically the production presence in California, most production is concentrated in states synonymous with business-friendly environments and population masses capable of satisfying extensive workforce needs. Namely, the most existing activity has been in Ohio, Texas, Georgia and South Carolina.

A wave of new project announcements across the United States

Due to nuances in the federal incentive program and overall logistical efficiencies, solar companies typically enter the U.S. market through module production. Therefore, the recent wave of announced activity is either module production from new entrants or upstream production (cell, wafer, ingot) from those already with a domestic module production presence. And on a few occasions, some companies simultaneously build out multiple aspects of their supply chain. The map below shows major announced photovoltaic projects across the United States.

The site selection implications of swimming upstream

Each photovoltaic manufacturing value chain component can have distinctly different site selection drivers. For example, module assembly does not require excessive utility capacities or a terribly specialized building. Therefore, module projects are quicker to operate because they can take advantage of speculative warehouses that are prevalent in most large metro areas (as long as they have enough power).

As companies ascend the value chain, the site selection process becomes more nuanced due to increasingly complex site selection drivers. For example, a 5 GW cell production operation can require 75+ MW of electricity, 5 million gallons of water per day with a discharge rate 60%+, and a significantly more specialized building than a speculative warehouse can offer.

Once a company eliminates those regions with high utility costs, constrained water resources and lack of a skilled workforce, the options quickly narrow. This narrowing can be even more constraining if the country of origin (China) needs to be addressed.

SSG’s 2024 outlook and advice for solar manufacturing companies

With each passing day, Site Selection Group is exposed to more and more chatter about upstream solar production investment in the United States. Much like most of the industry’s service providers, we are positioning our capabilities to continue to serve the needs of projects with significant market demand. Based on our experience siting multiple photovoltaic manufacturing operations, Site Selection Group can offer the following for any company contemplating a site selection exercise.

- Speed-to-market is still achievable for module production.

For those contemplating module projects, the opportunity to take advantage of vacant existing buildings is still available in the marketplace. Only a fraction of the existing product can meet the requirements of 20+ MW electric loads; however, there is ample space in the market to find a solution. - Sites for upstream production are constrained.

For those contemplating an upstream project (cell, wafer, ingot), do not underestimate market constraints for sites with adequate utility infrastructure. Hyperactivity in the U.S. manufacturing sector has cannibalized a significant portion of sites with heavy infrastructure adjacent. While good options still exist, overlaying electric, water, wastewater and workforce needs quickly shrinks the world.

- The pool of potential real estate development partners for upstream assets is significantly smaller than for module assembly assets.

Many of today’s module assembly projects are accommodated by traditional shell warehouses speculatively constructed by institutional developers. In most instances, these are lease transactions that enable companies to reduce the need for upfront capital. Because upstream assets are more specialized and capital-intensive, the pool of potential development partners is limited, forcing most companies to own their assets.

- If the country of origin is China, address it in the site selection process from the beginning.

Political opposition at the state level with the Committee on Foreign Investment in the United States (CFIUS) considerations can eliminate several states and regions. Addressing the country of origin before investing significant site selection resources can save valuable time and identify locations that would be more supportive of a project.