Site Selection Group's 2023 U.S. Economic Incentives Market Report

by Kelley Rendziperis, on Apr 4, 2023 9:00:00 AM

Capital investments in the manufacturing and industrial sector totaled more than $302 billion in 2022 — nearly equal to 2019, 2020 and 2021 combined. The manufacturing and industrial space experienced exponential growth in 2022 with capital investments soaring more than 70% over 2021 investments, which themselves were impressive amid concerns that the COVID-19 pandemic would negatively impact the sector.

2022 was another year of the megaproject — with seven megaprojects each garnering economic incentive awards exceeding $1 billion. In contrast, due to the remote workforce trend, economic incentives for call center operations totaled a mere $1.5 million.

Overall, approximately $27.5 billion of state and local economic incentives were awarded across all industries and project types, up from the $8.9 billion reported in 2021. The more than $302 billion that companies committed is expected to create over 400,000 new jobs, resulting in an average return on investment of 9.1% and $68,700 per job.

To help develop an economic incentive strategy, Site Selection Group summarizes economic incentive trends and market conditions by state in the newly released 2023 U.S. Economic Incentives Market Report, which can be downloaded here. The information contained in this report is typically reflective of publicly available state-level awards and excludes federal incentives such as $2.8 billion of Department of Energy grants to support the establishment and expansion of commercial-grade domestic factories for battery-grade lithium, graphite and nickel.

Economic Incentive Market Trends

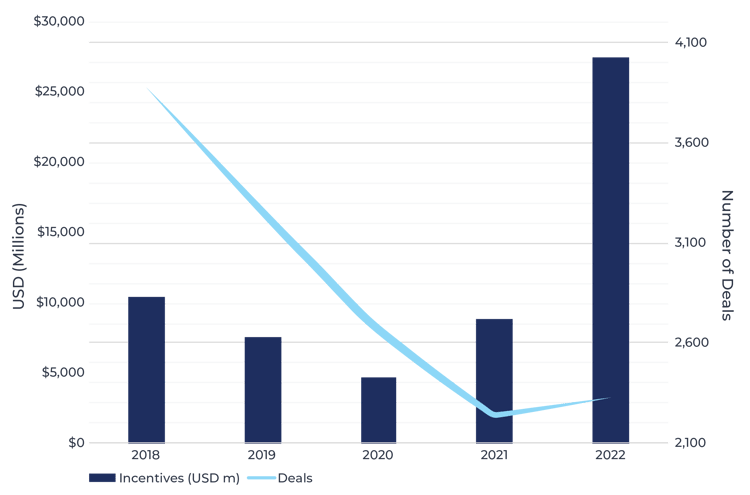

The inclusion of 2022 economic incentive statistics in a comparison of the prior five years reflects a remarkable growth in the total value of economic incentives awarded, with only a slight increase in the number of announced projects from the prior year. The number of reported economic incentive awards increased from 2,200 in 2021 to 2,326 and is still far below the number of awards reported in 2018, but slightly rising. The more than $27.5 billion of state and local economic incentives awarded in 2022 far exceeded the $8.9 billion reported in 2021, and nearly equaled the sum of awards reported from 2018 through 2021. The underlying basis of the significant growth of economic incentives is due to a rise in megaprojects tied to electric vehicles and/or electric vehicle battery manufacturing, semiconductor manufacturing, and steel manufacturing. Five megaprojects alone in these industries accounted for nearly half of the total economic incentives awarded, or over $13.3 billion.

Total Economic Incentives Awarded

2018-2022

Source: IncentivesFlow, a Service from FDI Intelligence.

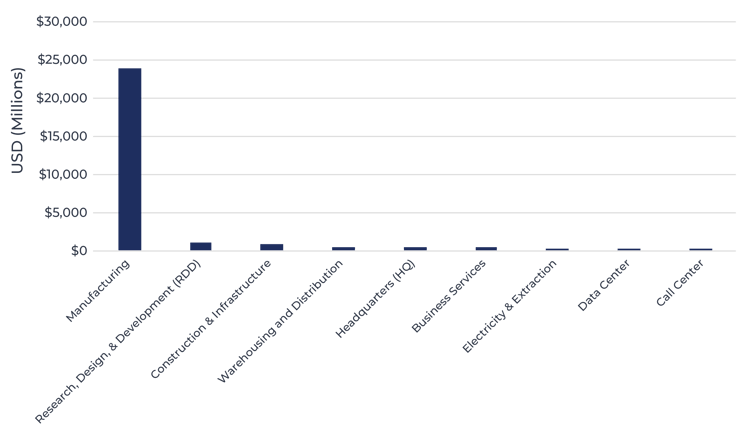

Economic Incentives by Project Type

The magnitude of economic incentives varies greatly by project type. Capital-intensive projects such as manufacturing and infrastructure projects typically receive the greatest amount of economic incentives as they are heavily incentivized by property tax abatements and infrastructure grants. Conversely, employee-intensive operations such as headquarters and business services are primarily incentivized by tax credits, training subsidies and cash grants which are typically valued less overall due to lower capital investment. The manufacturing sector continues to lead all industries in 2022 by garnering approximately $24 billion in economic incentive awards in exchange for an estimated $267 billion in capital investment and the commitment to create almost 200,000 jobs. The manufacturing industry in isolation offered incentives valued at approximately $120,000 per new employee and an 8.9% return on investment. Research, design & development projects remained the second largest project type with approximately $1 billion in economic incentives, of which 75% were related to film credits.

Source: IncentivesFlow, a Service from FDI Intelligence.

Conclusion

Even though we could be headed for a recession and are experiencing record-high inflation, a massive amount of economic incentive awards were announced in 2022.

Megaprojects in the electric vehicle, electric battery, steel and semiconductor industries led by Hyundai Motor Company, Rivian, Starplus Energy, Vingroup, Panasonic, Nucor, Micron and Intel accounted for more than half of the total economic incentives awarded throughout the U.S. and half of the total committed capital.

With the passage of the Inflation Reduction Act and the single largest investment in climate and energy in American history, 2023 is likely to see continued large investments in the electric vehicle sector, railways, wind and solar energy, battery storage, carbon capture, hydrogen and public services including water.

As megaprojects persist, the importance of state and local economic incentives in the site selection process cannot be diminished. To learn more about the most utilized economic incentive programs in the U.S., as well as notable 2022 projects and a comparison of economic incentive conditions by state, please download our 2023 U.S. Economic Incentives Market Report Whitepaper.

If you have any questions or would like additional information, please contact me at krendziperis@siteselectiongroup.com. Contributions by Matthew Kahn, Eileen Hughett, Will Ramirez and Billie Rodman.