Nearshore Call Center Region Beats U.S. in Job Creation for 2022

by King White, on Feb 20, 2023 9:00:00 AM

The U.S. call center market continues to be turned upside down due to wage inflation and challenging labor conditions. As a result, the nearshore region which is Latin America and the Caribbean created more jobs than the U.S. in 2022 based on data tracked by Site Selection Group.

The nearshore region now has an estimated 1.3 to 1.4 million call center employees and continues to grow. As a teaser to the upcoming release of Site Selection Group’s Global Call Center Location Trend Report, we wanted to release some of the results early to give you insight into some of the results.

Over 25,000 call center jobs announced across the nearshore region

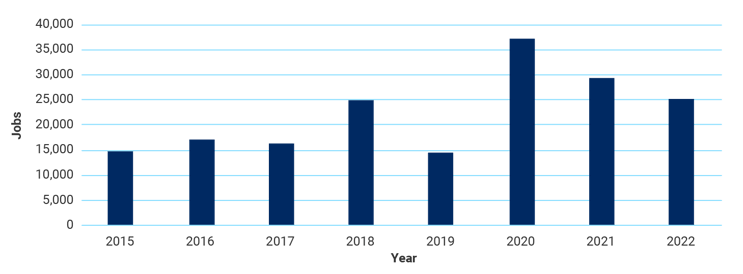

The nearshore region had another strong year with the creation of an estimated 25,235 jobs in call centers across the region. In comparison, the U.S. had a mere 17,503 jobs as U.S. companies shifted a lot of their call center growth to lower-cost nearshore and offshore geographies. The nearshore region of Latin America and the Caribbean was a clear beneficiary of the global movement in call center jobs. Below is a table showing the growth of this region over the last five years.

Key benefits of the region

The region includes approximately 25 countries and around 60 to 70 metro areas that you might want to consider if expanding in the region. Some of the key attributes of the region include the following:

- Labor costs generally range between $4 to $6 per hour which is 50% to 75% lower than what you’d pay for a U.S. call center worker.

- Accessibility is much easier than going to offshore locations such as India, the Philippines, or South Africa. Key gateway cities include Miami, Houston, Dallas, New York, and Charlotte.

- English skills are very good in the Caribbean, Mexico, Central America, and the Northern parts of South America.

- The time zone of the region is aligned to the U.S. which helps reduce after-hour wage premiums and better quality of life for the agents.

- The cultural affinity is more aligned with the U.S., especially across the Caribbean, Mexico, and Central America.

Negative factors of nearshore locations

The U.S. is clearly one of the best countries to conduct business while the nearshore region has some negative factors that you should consider carefully before expanding there. The following is a list of some of the items to evaluate during the site selection process to make sure it is the right location for your company.

- The region has become much more saturated with other call centers than it was a few years ago as indicated in the data outlined in this report. This has increased wages and employee attrition.

- Geopolitical and crime risks vary greatly by country so you need to carefully evaluate if there is too much risk for you.

- Labor market scalability can also be an issue since the primary language for a majority of the countries is Spanish. You need to closely evaluate labor conditions to determine if the labor market will support the size of the call center you want to open.

- Labor laws and taxes can also be very complicated and need to be carefully included in your total cost of doing business.

- The capital cost to enter the region is not cheap. Unlike in the U.S., landlords don’t fund the build-out costs of your call center, and there are very few vacated call centers available in the region due to the rapid growth.

- Weather risks are another important factor to evaluate, especially if you are considering the Philippines or coastal locations in Central and South America.

- It often takes nine to 12 months to get a site operational in nearshore markets since doing business there can be much slower and more complicated than it is in the U.S.

Conclusions

It has been incredible watching the growth of the Latin America and Caribbean region. The call center industry has a long history of cycling call center jobs back and forth from onshore to offshore then offshore to nearshore then back to the U.S. Predicting how long the labor markets in the region can support the growth will probably be the biggest factor that may ultimately slow growth. More details will be released in Site Selection Group’s upcoming Global Call Center Location Trend Report.