Largest Economic Incentive Deals of Third Quarter 2020

by Kelley Rendziperis, on Oct 21, 2020 8:50:34 AM

To help understand economic incentive trends, this report evaluates economic incentive deals announced during the third quarter of 2020.

$1.1 billion in economic incentives

As of the date of publication, Site Selection Group identified 302 economic incentive packages offered to companies across the United States during the third quarter of 2020. These economic incentive packages represent an estimated total incentive value of approximately $1.1 billion. To garner these economic incentives, companies are expected to make roughly $9.8 billion in capital investments and generate over 41,600 new jobs, resulting in:

- A total return on investment of approximately 11.1%;

- An average economic incentive award of $26,336 per new job;

- An average incentive award of approximately $3.6 million per project; and

- A median economic incentive award of approximately $405,000.

When compared to the third quarter of 2019, Q3 2020 had a drop in the number of projects by roughly 23%, from 391 to 302 projects. The largest declines between these two periods were the total value of capital investment (-33.1%), number of deals (-22.8%) and the total incentives value (-29.5%).

The largest announced economic incentive package this quarter was offered to Centene Corp., a provider of managed care services for public and private health plans, to build an East Coast regional headquarter and technology hub in Charlotte, North Carolina. The state and local incentives are estimated to be approximately $438.6 million over a 39-year period. The company plans to invest $1 billion to build a 1 million-square-foot campus and create more than 3,200 new jobs. The Job Development Investment Grant (JDIG) award is the largest job announcement in the history of the program.

Another notable project announced was the highly anticipated Tesla project in Texas. The company plans to make a $1.1 billion-dollar investment to create a 4 million-square-foot manufacturing facility for its Cybertruck and Model Y vehicles. In addition to the large capital investment, approximately 5,000 new jobs will be created with this project. Tesla was approved for an incentive package worth approximately $82.7 million in property tax abatements from the local county and school district.

The 302 announced projects during the third quarter represented 37 states, led by Ohio with 56 announced projects and Indiana with 30. North Carolina and Texas offered the largest value of announced economic incentives with $459.6 million and $166.1 million, respectively.

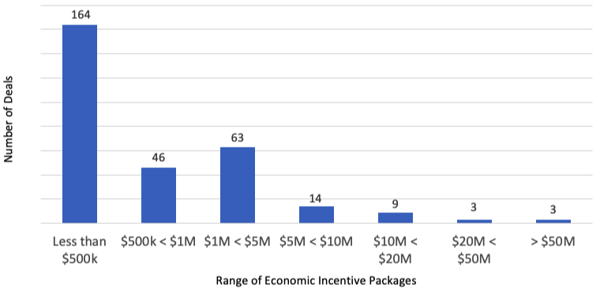

The following chart depicts the number of projects announced during the third quarter broken out by estimated economic incentive value:

Number of Projects by Incentive Value

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Approximately 69.5%, or 210 of the 302 announced projects, were awarded economic incentive packages valued at $1 million or less and 90.4% were awarded economic incentive packages valued at $5 million or less. While the average economic incentive package was valued at approximately $3.6 million for all 302 announced projects, the average package for the top 25 deals was approximately $34.6 million.

Economic incentives and industry trends

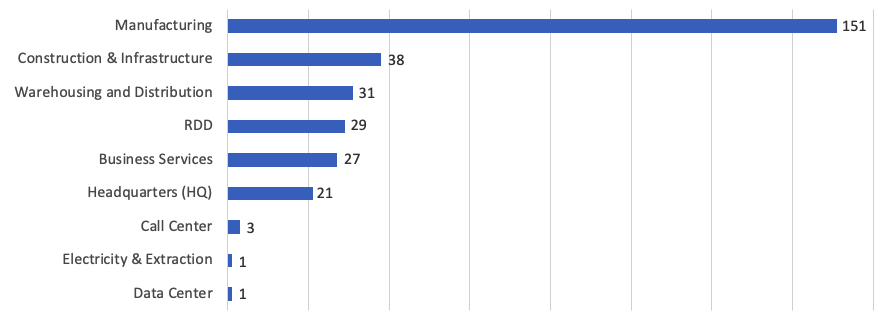

The following chart depicts the breakdown of the 302 announced projects during the third quarter of 2020 by industry function:

Number of Projects by Industry Function in Q3 2020

Data Source: IncentivesFlow, a service from WAVTEQ Limited

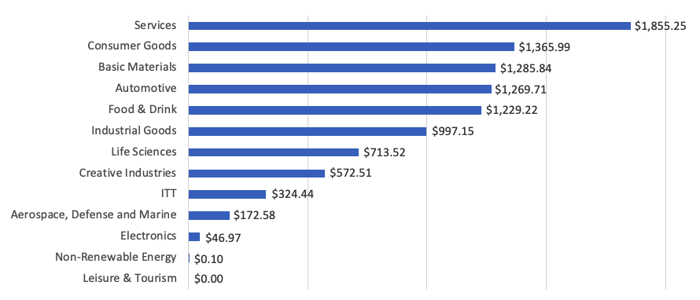

Manufacturing continues to be the top incentivized industry function this quarter based on the number of projects awarded. The top incentivized industry sectors based on estimated capital investment were the services and consumer goods sectors, which together account for nearly 32.8% of all the capital investment announced during this period. The services sector was led by Centene Corp., the largest deal of the third quarter, and United Parcel Service (UPS) which will invest $262 million to establish a new distribution facility in Graham, North Carolina.

The chart below illustrates the level of capital investment committed by industry sector this quarter:

CapEx Value by Industry Sector in Q3 2020 (USD m)

Data Source: IncentivesFlow, a service from WAVTEQ Limited

20 of the largest economic incentive packages in the third quarter

The top 25 economic incentive packages announced in the third quarter represent approximately $867 million of the total $1.1 billion of estimated incentives for all projects, or approximately 79.1%. These projects in isolation will account for:

- $5.4 billion of capital investment;

- 15,261 new jobs;

- A return on investment of approximately 16.0%; and

- $56,820 average award per new job.

The following table identifies some of the largest economic incentive deals (removing real estate development and film incentives) offered in Q3 2020. These projects provide a great way to benchmark the potential range of economic incentives for a variety of project types. However, it is important to understand these values are estimated and typically only reflect state level incentives.

| Company | State | Industry Function | Incentives Value ($M) | Capex ($M) | New Jobs |

|---|---|---|---|---|---|

| Centene Corp. | NC | Headquarters | $438.59 | 1034 | 3,237 |

| Tesla | TX | Manufacturing | $82.7 | 1100 | 5,000 |

| Gulf Coast Ammonia | TX | Manufacturing | $70.03 | 500 | 40 |

| TrueCore (Nucor) | IN | Manufacturing | $28.5 | 28.5 | 25 |

| Eli Lilly and Co. | IN | Manufacturing | $24 | 400 | 100 |

| DHL Supply Chain | TN | Warehousing & Distribution | $19.76 | 85.72 | 255 |

| Evraz North America | CO | Manufacturing | $15.00 | 200 | 1,000 |

| BAE Systems | IA | Manufacturing | $14.5 | 139.0 | 650 |

| Axon | AZ | Headquarters | $11.98 | 0.0 | 650 |

| Alabama Pellets | AL | Manufacturing | $10.35 | 95 | 45 |

| Lithium Nevada | NV | Electricity & Extraction | $8.61 | 514.3 | 113 |

| Agriculture Technology Campus | SC | Manufacturing | $8 | 314 | 1,500 |

| ALDI Einkauf | AL | Headquarters | $7.16 | 100 | 200 |

| Williams International | UT | Manufacturing | $6.81 | 60 | 300 |

| Sabre Industries | IA | Manufacturing | $6.18 | 25 | 76 |

| CANPACK Group | PA | Manufacturing | $6.00 | 366 | 400 |

| Milwaukee Tool Corp. | IN | Manufacturing | $5.00 | 7 | 480 |

| SCEYE | NM | Manufacturing | $5.0 | 50 | 140 |

| Wal-Mart | SC | Warehousing & Distribution | $5.0 | 220 | 1,000 |

| Mission Foods | IN | Manufacturing | $4.75 | 0 | 544 |

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Notable awards in the business services industry during the third quarter

Most projects are not nearly as sizable in terms of incentives offered as the top 20 highlighted above. Thus, we like to share notable Q3 projects garnering economic incentives in the business services and call center industries:

| Company | State | Industry Function | Incentives Value ($M) | Capex ($M) | Jobs Created |

|---|---|---|---|---|---|

| Clearcover | MI | Business Serv. | $3.9 | $5.0 | 300 |

| Encamp | IN | Business Serv. | $3.25 | $2.38 | 226 |

| Edify Labs | IN | Business Serv. | $2.75 | $2.61 | 150 |

| Marlowe Cos. | NM | Call Center | $0.91 | 0 | 361 |

| RDI Connect | IN | Call Center | $0.9 | $0.5 | 125 |

| ClaimDOC | IA | Business Serv. | $0.84 | $4.5 | 54 |

| T-Mobile US | VA | Call Center | $0.83 | $30 | 500 |

Data Source: IncentivesFlow, a service from WAVTEQ Limited

Conclusion

As noted above, the overall metrics of Q3 2020 are lower than Q3 2019 likely due to the coronavirus pandemic. However, there was only a very slight decrease in the number of projects from Q2 2020 to Q3 2020.

We encourage companies to review their economic incentive portfolios amid this pandemic to ensure they are staying in compliance with project commitments, especially as state and local jurisdictions are continually offering economic incentive compliance waivers and extensions. Site Selection Group can assist with reviewing economic incentive agreements and interfacing with governmental officials as needed.

Please note that the analysis above is based on publicly available data at the time of this blog. In addition, the current quarter’s data is compared to the information available at the time of prior quarterly blogs.

For additional information about these projects and others, please contact me at krendziperis@siteselectiongroup.com with any questions.