2019 Industrial Real Estate Outlook for Manufacturers

by Josh Bays, on Oct 22, 2019 2:00:50 PM

Companies that are manufacturing goods in the United States are painfully aware of the high-level of competition they currently face domestically. In what many consider to be a “peaking market,” the competitive pressures faced by U.S. manufacturers typically come in the form of workforce, support services, shipping services and sometimes even economic incentives.

However, this heightened activity has had a profound impact on the industrial real estate market for the last several years, and 2019 is no different. Site Selection Group, a full service location advisory, economic incentives and real estate services firm, helps manufacturing companies optimize their location decisions based on those site selection factors that will influence operational success. Those obvious site selection factors typically include logistics, workforce, business environment, infrastructure, utilities, regulatory environment, economic incentives and real estate. However, an underrated factor that is heavily influencing location decisions is time.

In a hyper-competitive landscape, almost all site selection projects face a speed-to-market concern. The most effective way to alleviate this concern in the site selection process is for manufacturers to focus on existing buildings rather than spending the time it takes to construct a facility. Depending on facility complexity, this approach can save between six and nine months.

Typical real estate profile of manufacturing projects

The term “industrial real estate” is often casually used as a catch-all for buildings that can support both production and distribution activities. However, the technical building specifications required for production uses are typically much more complex than those required for basic distribution. Often, facilities designed for production operations as opposed to basic distribution uses requires improvements to foundations, structural steel, utility capacity and distribution, and air movement. In summary, these facilities are more specialized and expensive.

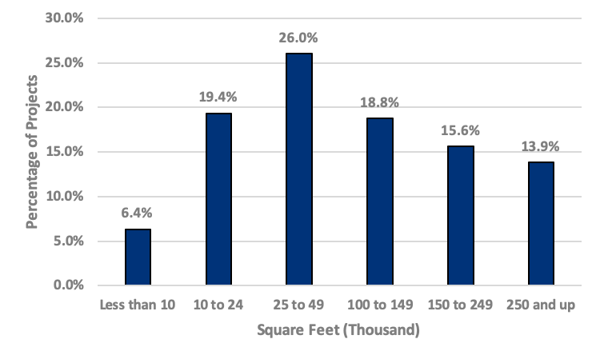

Another real estate trend that typically catches the casual industry observer off guard is the size profile of most manufacturing buildings. Although large mega manufacturing projects typically dominate the media headlines, the reality is that the vast majority of manufacturing projects require a facility under 150,000 square feet.

Conway tracks manufacturing investment in the United States, and while not 100% comprehensive, its database is an accurate representation of activity. Based on project data for 2019 representing 458 projects, the following chart shows the distribution of manufacturing projects based on facility size. As compared to the previous year, the distribution of projects remains roughly the same, but the percentage of projects under 150,000 square feet is higher (70.6% compared to 60.3%).

The industrial real estate market is active, but not much help to manufacturers

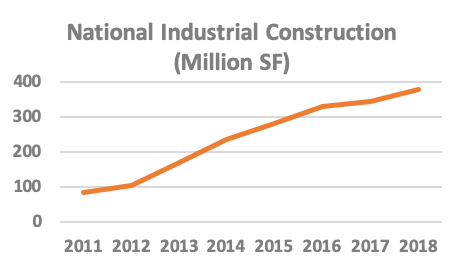

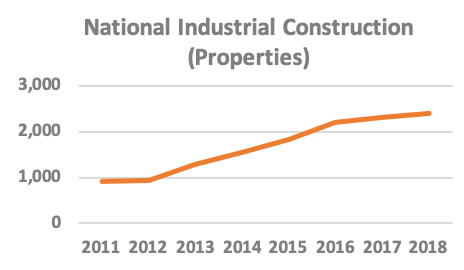

It is hard to spend much time driving around a metropolitan area of the United States and not notice the towering effect of construction cranes that dot the skyline. Industrial real estate construction, both total square footage and number of buildings, is at an all-time high.

Source: CoStar

Compared to just last year, there are 34 million more square feet under construction or delivered.

Unfortunately, these construction rates are rarely able to alleviate the speed-to-market concerns of manufacturers. Most of this activity, especially speculative activity, is on behalf of the institutional investment community and is focused on large buildings (larger than 250,000 square feet) with basic specifications. Unless a manufacturing project is willing to compromise its specifications and be shoehorned into a multitenant facility, it is usually resigned to constructing its own facility.

Could there be relief in sight?

During this approximately 10-year period of industrial growth in the United States, there have been a significant amount of companies that have grown their operations through acquisition. In what many observers believe to be a peaking market, we could be headed for a period where these acquisition-active manufacturers are looking to optimize their inefficient production footprints by implementing consolidation strategies.

If that happens, the U.S. industrial real estate market could see the largest influx of production-oriented buildings become available since the Great Recession. And, recently vacated production buildings can have one significant, and often overlooked advantage, an available workforce.

Best real estate practices in manufacturing site selection

Although the current market for quality production-oriented buildings is tight, Site Selection Group does not recommend abandoning that strategy if growing your production footprint. When that needle in the haystack is found, it can have a positively profound impact on a project. However, Site Selection Group advises clients to run a parallel site selection process aimed at greenfield locations. It is cheap insurance against the prospect that a company will have to extend its project timeline to combat this competitive real estate market.