U.S. Commercial Real Estate Office Challenges Continue into 2024

by King White, on Jan 16, 2024 8:00:00 AM

The commercial real estate office sector in the U.S. continues to face significant challenges going into 2024 as indicated by a record vacancy rate of 13.6%. Companies continue to shed office space, and 209 million square feet of sublease space was available by year-end 2023. Companies gave back over 65 million square feet of office space in 2023, bringing the total to over 180 million square feet since the beginning of 2020. By comparison, 50 million square feet of office space were vacated during the Great Recession, and 65 million square feet were vacated during the dot-com crash.

The current shift is primarily driven by the changing nature of work in the wake of the global pandemic and challenging economic conditions. Many businesses have adopted remote work and hybrid models as the new norm, resulting in a decreased demand for traditional office space. Additionally, high interest rates have caused a decline in building valuations. To help assess market conditions, Site Selection Group has summarized market trends and how they might impact your site selection and real estate decisions.

The pandemic’s lasting impact

COVID-19 played a pivotal role in accelerating the shift toward remote work. Companies that were once hesitant to allow employees to work from home found themselves with no other option during lockdowns. The success of this unplanned experiment led many businesses to rethink their need for physical office space, resulting in a surplus of vacant office buildings across major U.S. cities. However, some industry experts believe return-to-office mandates will begin to take shape in 2024 – potentially softening the blow to the office market. Our recent blog on The Great Return: Employers Calling for Return to Office identifies return-to-office mandates at some of the largest employers.

Surveys indicate slowing return to office

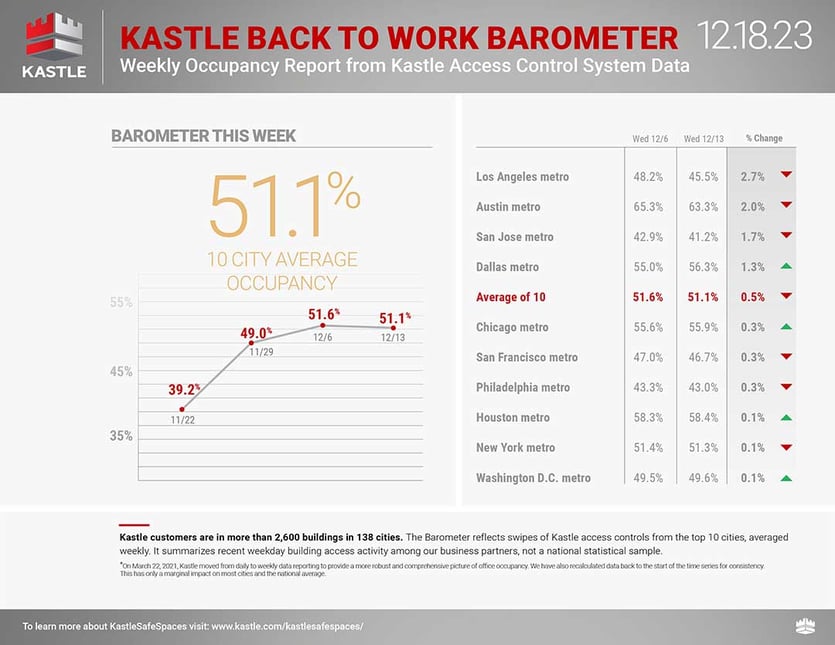

The Survey of Working Arrangements and Attitudes, the Placer.ai Office Index and the Kastle Systems Back to Work Barometer indicate office attendance has hardly moved during 2023, hovering between 50% and 65%, depending on the metro area. Other metrics, including transit ridership in major cities, indicate that foot traffic in central business districts has increased modestly, to 70% or more of pre-pandemic levels.

Flight to quality

Class A office properties, which have a vacancy rate of 7.9%, have been very resilient as companies continue to upgrade their office space to higher-quality buildings with an abundance of amenities in an effort to get employees back into the office. Class B and C buildings, which have vacancy rates of 14.5% and 23.4%, respectively, are struggling the most and will be faced with an uncertain future as loans mature and values remain weak.

Economic implications

The decline in demand for office space and high-interest rates have caused serious economic implications for the office sector. Property owners are struggling with lower rental incomes and a decrease in the value of their assets. This situation is particularly challenging for real estate investment trusts (REITs) and investors who heavily invested in office properties. Additionally, municipalities are facing a reduction in property tax revenue, which could impact public services.

Adaptation and repurposing

In response to these challenges, some property owners are repurposing Class B and C office buildings for other uses, such as residential units, storage facilities, or mixed-use developments. This adaptive reuse can help mitigate losses and rejuvenate urban areas affected by the decline in office occupancy. Office-to-residential conversions have gained the most momentum in older office buildings in the central business districts of some of the country’s largest metro areas.

The future of work and real estate

As the trend toward remote and hybrid work continues, the office market sector must adapt to survive. This may involve innovative designs for office spaces that cater to the new way of working, such as flexible layouts and coworking spaces. The industry must also focus on creating spaces that foster collaboration and community, aspects of work that employees miss when working remotely.

Conclusion

The U.S. office real estate sector is undergoing a period of significant change. The shift toward remote work, accelerated by the pandemic, has led to a reevaluation of the need for traditional office spaces. While this poses challenges, it also opens up opportunities for innovation and sustainable urban development. The future of commercial real estate will depend on its ability to adapt to the evolving needs of the workforce. Only time will tell if return-to-work employer mandates will be enough to help the office market recover.