Top Manufacturing Trends in the First Half of 2019

by Josh Bays, on Jul 23, 2019 1:44:40 PM

Site Selection Group, a leading location advisory and economic incentives firm, researched site selection trends for new and expanded manufacturing operations announced in the first half of 2019. There were over 350 manufacturing projects announced in the United States in the first half of this year, according to Conway Analytics. Although manufacturing operations have a natural tendency to cluster together in metro areas, it is essential for a new potential entrant to critically assess how recent growth will affect operating costs and conditions. Specifically, workforce, real estate, transportation service providers and economic incentives in those markets.

Metros with high manufacturing project announcements and growth

Site Selection Group identified the top 10 metro areas with highest project activity of significant manufacturing deals over the past six months.

| Metro Area | Projects Announced |

|---|---|

| Indianapolis-Carmel-Anderson, IN | 10 |

| Detroit-Warren-Dearborn, MI | 9 |

| Atlanta-Sandy Springs-Alpharetta, GA | 8 |

| Greenville-Anderson, SC | 7 |

| Tulsa, OK | 7 |

| Huntsville, AL | 6 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 6 |

| Charlotte-Concord-Gastonia, NC-SC | 5 |

| San Francisco-Oakland-Berkeley, CA | 5 |

| Cincinnati, OH-KY-IN | 5 |

Comparing distribution job growth to the nation

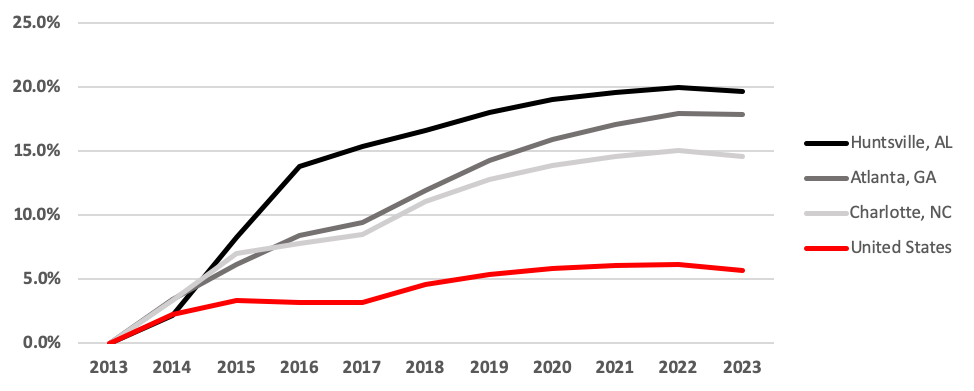

While growth in some of these markets is consistent with national growth rates, there are several that significantly outpace the national growth rate. As shown below, indicative high-growth markets like Huntsville, Alambama; Atlanta and Charlotte, North Carolina; have seen significant growth in production-related jobs over the past five years and are projected to continue to grow rapidly in the future.

This type of growth can have a dramatic effect on operating costs, especially wages and real estate.

Job Growth in Selected Markets

Source: EMSI Historic and Projected Growth Rates, Production Occupations

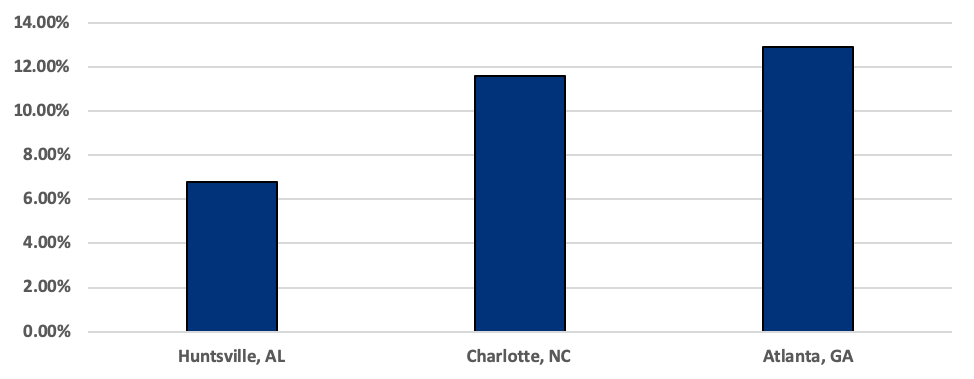

A look at production wage inflation in active markets

A critical factor new market entrants need to consider is how wages are growing in these active production markets. The chart below displays wage growth for production occupations in the fast-growing markets highlighted previously. Moderate- to fast-growing wages is something critical to the bottom line, however, reliable metro-level wage growth for specific occupations is difficult to estimate using traditional sources. As a result, it is critical for companies and their partners to use a mix of data sources and conduct interviews with employers in staffing agencies in all candidate markets to understand what real market wages are today.

Production Workers Historical Wage Inflation 2013-2018

Source: EMSI Historical Median Hourly Earnings, 2013-2018, Production Occupations

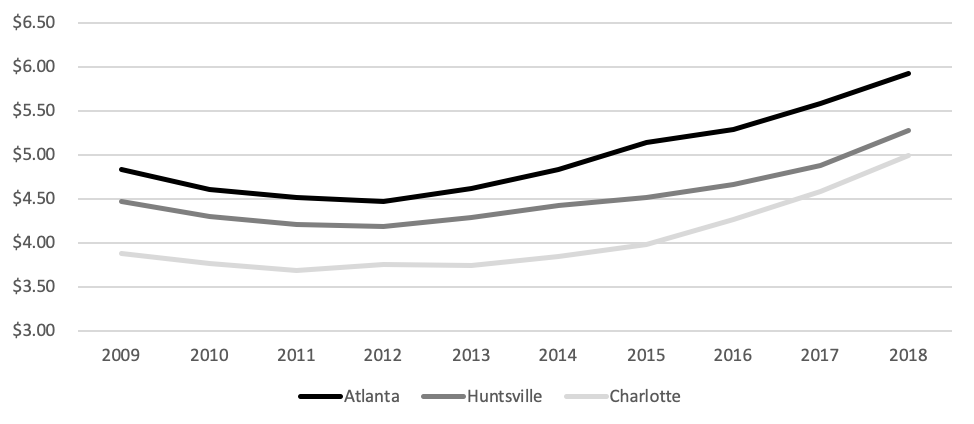

Examining industrial real estate market rent

Evaluating market costs for real estate is another critical consideration for new and expanding production facilities. It comes as no surprise that as jobs are added in the industrial space, real estate costs continue to grow. Again, it’s critical to combine a comprehensive search for real estate along with an in-depth analysis of workforce conditions especially in these fast-growing markets to ensure an optimal site selection decision.

Production Facility Market Rents in Selected Markets

Source: CoStar

First half 2019 US production announcements

While we’ve used a handful of fast-growing production metro areas to demonstrate how market dynamics can change, the map below displays manufacturing projects announced in the first half of 2019. It is apparent that there is good manufacturing activity occurring across the country. Hover over a point for additional data. Before entering or expanding in one of these markets, Site Selection Group would counsel its clients to take a holistic approach to examining the strengths and weaknesses of each market including understanding workforce availability and quality, accessibility, infrastructure, competitive pressures, wage trends and real estate climate.