Top Distribution Center Site Selection Trends for Q2 2020

by Josh Bays, on Sep 23, 2020 9:48:42 AM

Note from the author: This research contained in this trend report does not reflect the full effect of the COVID-19 pandemic. Site Selection Group anticipates those trends to become more apparent in second quarter data.

Site Selection Group closely monitors national distribution center investment activity, as well as trends related to real estate, economic incentives and workforce. During the second quarter of 2020, publicly announced distribution center projects in the United States created at least 6,274 jobs at 71 facilities. These projects include well-known companies such as Amazon, Ross Stores, Associated Wholesale Grocers, and FedEx.

Notable Distribution Center Announcements

| Company | Metro Area | Capital Investment ($M USD) | # of Jobs |

|---|---|---|---|

| Associated Wholesale Grocers | Memphis, TN | $300.0 | 79 |

| Cargill | Eddyville, IA | $210.0 | 14 |

| Aircraft Solutions USA | Kinston, NC | $100.0 | 475 |

| Carbonlite Industries | Orlando, FL | $80.0 | Undisclosed |

| Medline Industries | Savannah, GA | $70.0 | 150 |

| Ross Stores | Columbia, SC | $68.0 | 700 |

| Prime Beverage Group | Charlotte, NC | $68.0 | 231 |

| The Coca-Cola Company | Indianapolis, IN | $55.0 | Undisclosed |

| Menard | Cleveland, OH | $54.0 | 90 |

| Parallel Products of New England | Providence, RI | $50.0 | Undisclosed |

| Fedex Corporation | Denver, CO | $36.0 | 100 |

| Unix Packaging | Hickory, NC | $19.0 | 226 |

| Amazon.com | Wilmington, DE | Undisclosed | 1,000 |

| Amazon.com | Albuquerque, NM | Undisclosed | 1,000 |

| United Parcel Service | Philadelphia, PA | Undisclosed | 352 |

| Americold Realty Trust | Providence, RI | Undisclosed | 200 |

| Americold Realty Trust | Lancaster, PA | Undisclosed | 200 |

| Amazon.com | Madison, WI | Undisclosed | 25 |

| Uline | Ontario, CA | Undisclosed | Undisclosed |

| Omni Logistics | Boston, MA | Undisclosed | Undisclosed |

Source: Conway Analytics

Larger markets remained active

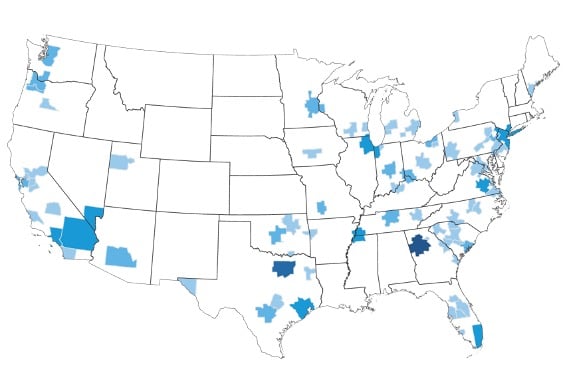

Over the past quarter, distribution center operators have announced projects all across the country. There was substantial activity in larger markets like Dallas and Atlanta, while mid-sized markets also remained active.

While this data is not completely comprehensive, it is an accurate proxy for areas of the country that have experienced the most activity.

Economic incentives continue to be meaningful to the distribution industry

The following table highlights notable economic incentive packages for distribution center projects. For these notable projects, economic incentive packages averaged 19% of the estimated project capital investment and were also clustered around large distribution-intensive markets.

Notable Distribution Center Economic Incentives Deals

| Company | Metro Area | Incentive ($M USD) | Investment ($M USD) | New or Retained Jobs |

|---|---|---|---|---|

| Deutsche Post | Memphis, TN | $2.4 | $20.8 | 105 |

| Dollar General | Cincinnati, OH | $1.3 | $26.0 | 65 |

| Quality Logistics (Longship Logistics) | Lexington, KY | $1.3 | $4.3 | 155 |

| BuildMyPlace | Louisville, KY | $1.1 | $15.3 | 100 |

| Artistic Weavers | Fresno, CA | $0.8 | $21.0 | 64 |

| Meijer Companies | Dayton, OH | $0.8 | $160.0 | 290 |

| Puyang Refractories Group Company | Cincinnati, OH | $0.6 | $5.5 | 32 |

| Santarosa Holdings | Buffalo, NY | $0.5 | $2.2 | 11 |

| The Home Depot | Scranton, PA | $0.5 | $0.0 | 500 |

| Project Cyclone | Jacksonville, FL | $0.5 | $10.1 | 643 |

| Rural King | Waverly, OH | $0.4 | $17.0 | 75 |

| Forager Group | Chicago, IL | $0.4 | $1.3 | 40 |

| American Nuts | Akron, OH | $0.3 | $4.4 | 60 |

| Medline Industries | Savannah, GA | $0.3 | $70.0 | 150 |

| General Airframe Support | Roswell, NM | $0.2 | $0.0 | 16 |

| Dothan Warehouse Freezer Storage | Dothan, AL | $0.2 | $14.0 | 70 |

| Artistic Holiday Designs | Fort Wayne, IN | $0.1 | $0.0 | 12 |

| Dollar General | Zanesville, OH | $0.1 | $18.5 | 813 |

| Project Gauge | Charlotte, NC | $0.1 | $5.1 | 86 |

| Markee Fashion & Design | Flint, MI | $0.1 | $0.0 | 5 |

Source: Incentives Monitor