Office Sublease Market Peaking at 200 Million Square Feet Creating Window of Opportunity for Tenants

by King White, on Apr 20, 2021 2:17:21 PM

The office real estate sector continues to feel the brunt of the COVID-19 pandemic. The sector was completely disrupted by the success of work-from-home strategies. The amount of office sublease space on the market has increased by 60% to almost 200 million square feet nationally and appears to be peaking. To help you develop a corporate real estate strategy, Site Selection Group has summarized market conditions and some of the actions that companies are taking in light of the unique market conditions.

Large metro areas were hit the hardest

With 198 million square feet of sublease space on the market in Q1 2021, the largest metro areas in the U.S. such as New York City, San Francisco, Los Angeles, Boston, Chicago, Dallas and Washington D.C. were hit the hardest as explained in our previous blog Office Sublease Market Increases to 132 Million Square Feet Due to COVID-19 Pandemic. Downtown central business districts of these cities became ghost towns as a result due to social distancing, mass transit and urban density challenges. The impacts will be long term on companies, employees and the communities as a result.

Corporate real estate strategies continue to evolve in both directions

Corporate real estate strategies vary greatly from company to company. The hybrid work-from-home model is being implemented by many companies which means companies need less space. As a result, vacancies are up and leasing activity is down. Companies like State Farm and Comcast have put large blocks of space up for sublease across the country while companies like Amazon and Alphabet are still taking down more space as they take advantage of market conditions and plan long term for the future.

Companies are taking advantage of market conditions

Most office landlords are very nervous which has created one of the strongest tenant-favored markets we have seen since the Great Recession in 2009. As an exclusive tenant representation firm, we see this as a once-in-a-decade opportunity to reduce your real estate costs through subleases, dispositions, early renewals and lease restructuring.

Real estate data analytics firm, VTS, released some very interesting data in a recent Wall Street Journal article. VTS indicates long-term leases of four years or longer are being offered at rents 13% below rental rates proposed prior to the COVID-19 pandemic. Companies are also looking for 10% less space. Market activity has declined 40% over the same time. VTS reported 1,302 companies started searches for office space in the top seven office markets in the first quarter. That compares to 2,171 searches in the first quarter of 2020.

The window of opportunity is closing soon for tenants

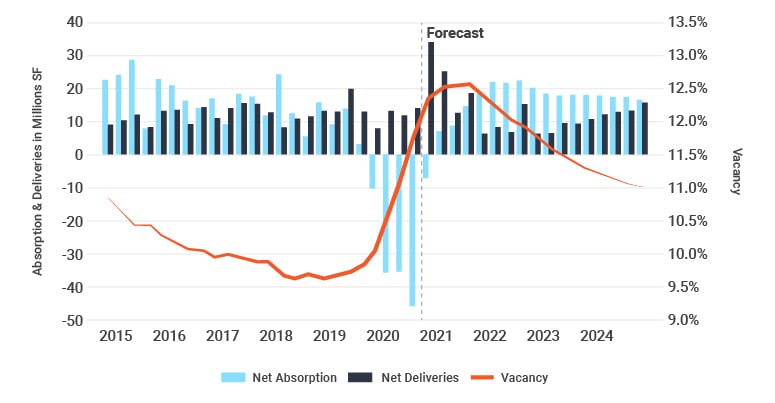

The window of opportunity for the best terms possible is likely over the next nine to 12 months. With the current vacancy rate at 13% nationally and forecast to decrease to 11% by the end of 2021, the best time to get the best deal possible is now.

In addition, rents are forecast to bottom-out during the same time. The following graph from the CoStar Group provides an excellent snapshot of historic and forecast market conditions illustrating how the market will bottom out in the coming year.

Source: Costar Group

Largest new leases signed in Q1 2021

Some companies are taking advantage of market conditions across the country for both new leases and lease renewals. Most landlords are very nervous right now; however, it is a great time to negotiate with landlords as the market shifts from a landlord market to a tenant-favored market. Below are some of the largest leases signed in Q1 2021:

|

Company

|

Location

|

Square Footage

|

Lease Type

|

Industry

|

|

Amazon

|

Boston, MA

|

706,996

|

New Lease

|

Retail

|

|

The Blackstone Group

|

New York, NY

|

652,615

|

Renewal

|

Financial Services

|

|

Amazon

|

Bellevue, WA

|

600,000

|

New Lease

|

Retail

|

|

Anduril

|

Costa Mesa, CA

|

449,206

|

New Lease

|

Technology

|

|

U.S. Department of Agriculture

|

Kansas City, MO

|

327,865

|

Renewal

|

Government

|

|

U.S Postal Service

|

Forest Park, GA

|

322,268

|

Renewal

|

Transportation

|

|

Tech Data Corp.

|

Clearwater, FL

|

285,100

|

New Lease

|

Wholesaler

|

|

Beyond Meat

|

El Segundo, CA

|

281,110

|

New Lease

|

Food & Beverage

|

|

Sabre

|

Southlake, TX

|

265,000

|

New Lease

|

Technology

|

|

Hewlett Packard Inc.

|

Vancouver, WA

|

248,972

|

Renewal

|

Technology

|

|

Bank of America

|

San Francisco, CA

|

247,000

|

Renewal

|

Financial Services

|

|

Loomis, Sayles & Co.

|

Boston, MA

|

232,953

|

Renewal

|

Financial Services

|

|

Lockheed Martin Corp.

|

Highlands Ranch, CO

|

206,951

|

New Lease

|

Manufacturing

|

|

Global Payments

|

Alpharetta, GA

|

206,542

|

New Lease

|

Financial Services

|

|

DC Department of Health

|

Washington, D.C.

|

202,143

|

Renewal

|

Government

|

|

Blank Rome LLP

|

Philadelphia, PA

|

200,270

|

Renewal

|

Legal

|

|

Microsoft Corp.

|

Arlington, VA

|

181,174

|

New Lease

|

Technology

|

|

Fredrikson & Byron, P.A.

|

Minneapolis, MN

|

178,191

|

New Lease

|

Legal

|

|

Waymo

|

Mountain View, CA

|

170,825

|

New Lease

|

Automotive

|

|

Icahn School of Medicine at Mount Sinai

|

New York, NY

|

167,348

|

New Lease

|

Medical

|

|

Ann Taylor

|

New York, NY

|

149,743

|

Renewal

|

Retail

|

|

Houlihan Lokey

|

New York, NY

|

148,232

|

New Lease

|

Financial Services

|

|

Dept. of Employment and Economic Development

|

Saint Paul, MN

|

147,577

|

New Lease

|

Government

|

|

Qualcare Inc.

|

Piscataway, NJ

|

145,430

|

Renewal

|

Healthcare Services

|

|

10x Genomics

|

Pleasanton, CA

|

144,155

|

New Lease

|

Biotechnology

|

Source: Costar Group

Conclusions

The office market is going through a massive disruptive trend which can create opportunities for companies that want to take advantage of it. The window of opportunity is beginning to shrink as offices are reopening and employees are returning to their office in full or partial capacity. Companies need to consider taking advantage of market conditions as the market shifts from one controlled by landlords to one controlled by tenants. If your company is in a position to make decisions about your future office space needs then now is a great time to negotiate with landlords.