Largest Economic Incentive Deals of Second Quarter 2023

by Kelley Rendziperis, on Sep 11, 2023 5:00:00 PM

In the ever-evolving world of economic development, economic incentives play an impactful role in where companies decide to locate and contribute to regional growth. These perks help companies grow, which in turn creates jobs, attracts capital investment, generates state and local taxes, builds talent and drives innovation. To understand the magnitude and type of economic incentives awarded, Site Selection Group summarizes 349 announced economic incentive awards offered to companies in the United States during the second quarter of 2023 (Q2 2023).

$6.3 billion in economic incentives

These economic incentive packages represent an estimated total incentive value of approximately $6.3 billion. To garner these economic incentives, companies are expected to spend roughly $38.4 billion of capital investment and generate close to 42,100 new jobs, resulting in:

- A total return on investment of approximately 16.4%

- An average economic incentive award of $150,070 per new job

- An average incentive award of approximately $18.1 million per project, which is heavily skewed by mega projects

- A median economic incentive award of approximately $450,000

In this quarter, economic incentive awards totaled $6.3 billion, reflecting a decrease of $780 million compared to last quarter; however, this figure is significantly higher than the corresponding period last year, which reported $4 billion of announced awards.

Further comparing Q2 2023 to Q2 2022, there was an impressive 57% upswing in the total value of announced economic incentive awards, alongside a remarkable 282% surge in the average award per job. This increase is significant because of the approximately 40% reduction of announced awards from 580 to 349. Interestingly, while there were more incentives awarded, capital investment declined by 19% and projected new jobs decreased by 59% from this time last year.

The largest announced economic incentive award this quarter was offered to TerraPower, a leading nuclear reactor design and development firm. The company secured a staggering $3.5 billion in incentives from the U.S. Department of Energy and the Bipartisan Infrastructure Law. TerraPower is set to create 250 jobs and invest $2 billion to establish a state-of-the-art 345-megawatt natrium demonstration nuclear reactor in Kemmerer, Wyoming.

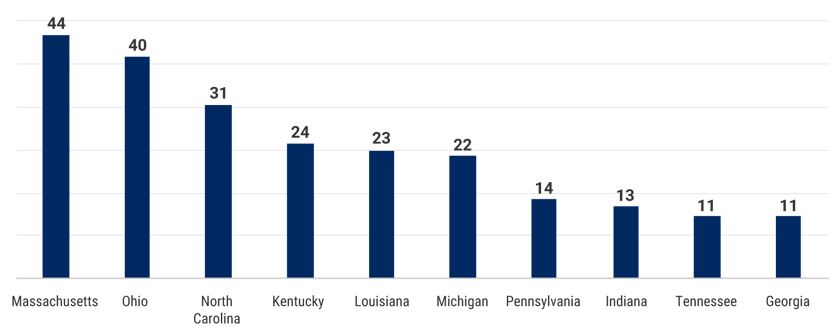

The 349 announced projects during the second quarter represented 38 states led by Massachusetts with 44 and Ohio with 40 announced projects. Wyoming and Oregon offered the largest amount of announced economic incentive awards totaling $3.5 billion and $1 billion, respectively. The most notable project from Wyoming is TerraPower as previously detailed above. In Oregon, Amazon was approved for $1 billion in tax credits from the Port of Morrow Port Commission. Amazon plans to invest $12 billion to establish new data center facilities. The company will create 600 new jobs paying an average annual wage of $75,000.

Top 10 States for Number of Announced Incentive Packages

Source: IncentivesFlow, a Service from FDI Intelligence

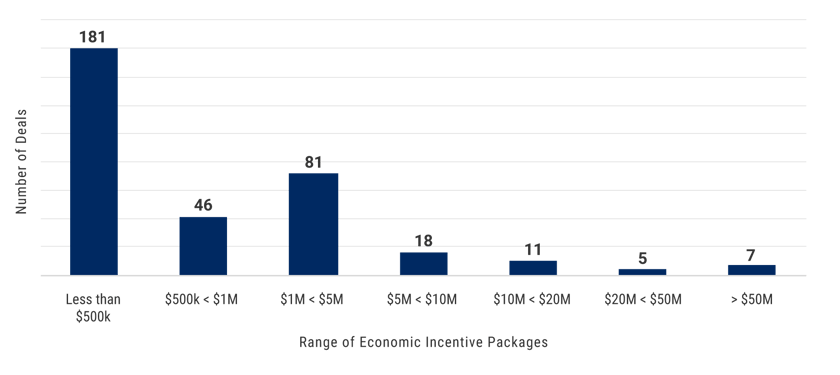

Source: IncentivesFlow, a Service from FDI IntelligenceThe following chart depicts the number of projects announced during the second quarter broken out by estimated economic incentive value:

Source: IncentivesFlow, a Service from FDI Intelligence

Source: IncentivesFlow, a Service from FDI Intelligence

TerraPower and Amazon in isolation accounted for 71% of the total awards for Q2 2023. Approximately 65%, or 227 of the 349 announced projects, were awarded economic incentive packages valued at $1 million or less and 88% were awarded economic incentive packages valued at $5 million or less.

Economic incentives and industry trends

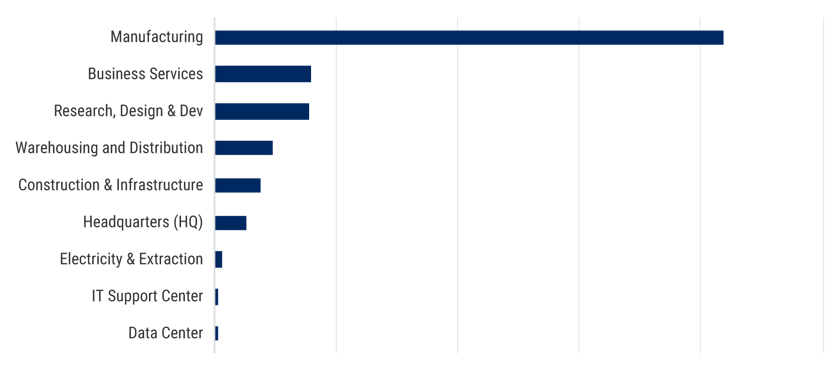

The following chart depicts the breakdown of the 349 announced projects during Q2 2023 by industry function:

Source: IncentivesFlow, a Service from FDI Intelligence

Source: IncentivesFlow, a Service from FDI Intelligence

Manufacturing continues to be the top incentivized industry function this quarter. The sector was led by Regeneron Pharmaceuticals, SK On, Eli Lilly, Enel and 6K.

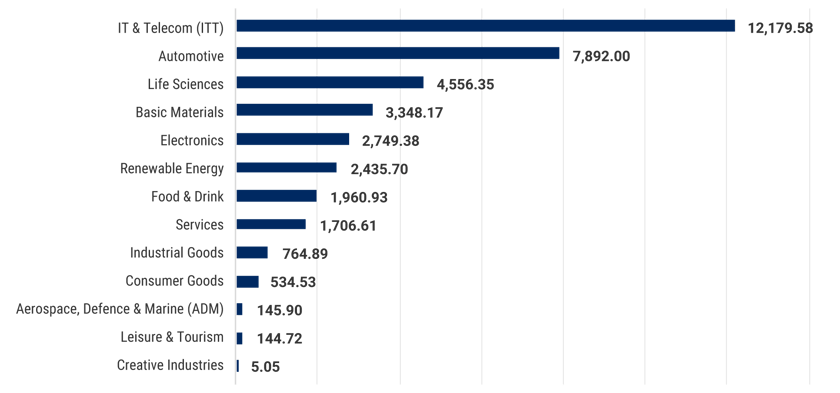

The chart below illustrates the level of capital investment committed by industry sector this quarter:

Source: IncentivesFlow, a Service from FDI Intelligence

The top industry sectors in terms of projected capital investment were the automotive and information technology and telecom sectors, which together account for about 52% of all the investment announced during this period.

Notable economic incentive packages in the second quarter

The top 25 economic incentive packages, excluding film and real estate projects, announced in Q2 represent approximately $5.9 billion of the total $6.3 billion of estimated incentives for all projects, or approximately 94.5%. These projects in isolation will account for:

- $29 billion of capital investment

- 13,843 new jobs

- A return on investment of approximately 20.4%

- An average award per new job of $430,943

The following table identifies some of the largest economic incentive deals, excluding real estate development and film incentives, offered in Q2 2023. These projects provide a great way to benchmark the potential range of economic incentives for a variety of project types. However, it is important to understand these values are estimated and typically only reflect state-level incentives.

Company |

Location |

Industry Function |

Incentives Value (USD M) |

CapEx

|

Jobs Created |

| TerraPower | Kemmerer (WY) | Research, Design & Dev | $3,500.00 | $2,000.00 | 250 |

| Amazon | Multiple locations (OR) | Data Center | $1,000.00 | $12,000.00 | 600 |

| Regeneron Pharmaceuticals | Tarrytown (NY) | Manufacturing | $310.67 | $1,800.00 | 1,000 |

| SK On | Unspecified (GA) | Manufacturing | $298.00 | $5,000.00 | 3,750 |

| Eli Lilly and Company (Eli Lilly) | Lebanon (IN) | Manufacturing | $293.09 | $1,600.00 | 200 |

| Enel | Inola (OK) | Manufacturing | $218.62 | $1,800.00 | 0 |

| 6K | Jackson (TN) | Manufacturing | $50.00 | $216.00 | 230 |

| James Richardson & Sons | Memphis (TN) | Manufacturing | $35.95 | $220.00 | 0 |

| Medpace Holdings | Cincinnati (OH) | Research, Design & Dev | $33.00 | $150.00 | 1,500 |

| General Motors (GM) | Roanoke (IN) | Manufacturing | $24.50 | $622.00 | 0 |

| The Coca-Cola Company | Webster (NY) | Manufacturing | $21.00 | $650.00 | 250 |

| Flagship Pioneering | Andover (MA) | Business Services | $20.00 | $325.00 | 600 |

| Re:Build Manufacturing (Re:Build) | New Kensington (PA) | Manufacturing | $16.50 | $50.00 | 300 |

| Verbio Vereinigte Bioenergie | South Bend (IN) | Manufacturing | $16.50 | $232.50 | 8 |

| ProKidney | Greensboro (NC) | Manufacturing | $15.00 | $458.00 | 330 |

| Embue | Cahokia (IL) | Research, Design & Dev | $14.81 | $0.00 | 200 |

| Project Forge | Denver (CO) | Business Services | $14.00 | $40.00 | 800 |

| Shin-Etsu Chemical Co | Plaquemine (LA) | Manufacturing | $13.55 | $1,321.00 | 115 |

| Meissner Filtration Products | Winterville (GA) | Manufacturing | $12.50 | $250.00 | 1,700 |

| Charlotte Pipe and Foundry Company | Maize (KS) | Manufacturing | $10.25 | $80.00 | 50 |

Notable awards in the business services industry during the second quarter

Most projects are not nearly as sizable in terms of incentives offered as the 20 highlighted above. Thus, we share notable Q2 projects garnering economic incentives in the business services and call center industries. As reflected below, there were no call center projects announced in this period:

Company |

Location |

Industry Function |

Incentives Value (USD M) |

CapEx

|

Jobs Created |

| Flagship Pioneering | Massachusetts | Business Services | $30.00 | $500.00 | 3,750 |

| Project Forge | Colorado | Business Services | $3.10 | $3.00 | - |

| Lyseon North America | Oklahoma | Business Services | $2.43 | $0.00 | 491 |

| Project Eye in the Sky | Colorado | Business Services | $2.00 | $0.00 | 311 |

| Marshall of Cambridge (Holdings) | North Carolina | Business Services | $1.95 | $3.23 | 103 |

| Marshall of Cambridge (Holdings) Ltd | North Carolina | Business Services | $1.20 | $0.03 | 49 |

| Crosscountry Mortgage | Ohio | Business Services | $1.00 | $0.00 | 760 |

| LJ | Michigan | Business Services | $1.00 | $2.50 | 100 |

| Legence | Kentucky | Business Services | $0.80 | $14.72 | 76 |

| Veneklasen Construction | Michigan | Business Services | $0.40 | $16.00 | 20 |

Conclusion

Economic incentives are powerful drivers in shaping business decisions and regional growth, evident in the $6.3 billion awarded in Q2 2023, spurring over $38 billion in investments and nearly 42,100 jobs. Despite a 40% decrease in the number of announced awards, these incentives resulted in a 57% increase in total incentive value compared to the previous year, underscoring their enduring impact on economic progress.

Please note that the analysis above is based on publicly available data at the time of this blog. In addition, the current quarter’s data is compared to the information available at the time of prior quarterly blogs.

For additional information about these projects and others, please get in touch with me at krendziperis@siteselectiongroup.com with any questions.

Contributions by Matthew Kahn.