Is the Land Real Estate Market Softening for Manufacturers?

by Josh Bays, on Apr 21, 2023 1:22:13 PM

Despite the recent rhetoric of a recession, domestic manufacturing activity remains strong on the backs of broad re-shoring initiatives and federal incentives for key sectors. Additionally, the profile of manufacturing site selection projects seems to change daily. Of note, capital profiles are continually increasing, and manufacturing facility needs are becoming more specialized. Both trends have a profound impact on how a company should approach the real estate component of their site searches.

Site Selection Group, a full-service location advisory, economic incentive and real estate services firm, is on the front lines of site selection projects for manufacturers. As such, we anticipate a change in real estate market dynamics that will likely benefit manufacturers.

The traditional industrial development profile

Prospective clients always ask, “How’s the industrial real estate market?” but they fail to distinguish the nuances that make distribution real estate needs fundamentally different than those of manufacturers. The overwhelming majority of industrial development in the United States has been buildings suited for big box distribution. These concrete boxes typically have the following characteristics:

- Ceiling heights: 36’-40’ clear

- Column spacing: 55’x 50’

- Floor thickness: 6” - 7”

- Electric capacity: just enough power to turn on lights and charge forklifts

- Site configuration: max out the site with the largest possible building footprint

- Transaction type: lease only

Unless it’s a basic assembly-type operation, the needs of most manufacturers conflict with the aforementioned items. However, recent flexibility on the “lease only” requirement is softening the market for land sites once earmarked for distribution development.

Because most capital-intensive manufacturing site selection projects cannot shoehorn their operations into vanilla boxes due to the need for structural steel and floor enhancements, increased utility capacity, or special configurations, many projects have resulted in acquiring land for purpose-built facilities.

Throughout the industrial development boom over the last several years, institutional developers have been on a land banking mission in Tier 1 markets across the country (Phoenix, Dallas, Atlanta, etc.) as it’s a precursor to vertical development. This put traditional developers and manufacturers on a collision course as they competed for sites in markets with large population bases. Distribution companies found value in proximity to consumers and transportation infrastructure, and manufacturers found value in proximity to workforce and transportation infrastructure.

Lease vs. own paradox

Just like with any decision, the path of leasing vs. owning is full of tradeoffs. However, it is undeniable that higher capital investment projects are more likely to want to own their assets. Because institutional developers control most of the sites with infrastructure on the periphery of large markets across the country, and because the lucrative returns of leasing preclude them from selling sites, it became almost impossible for manufacturers to buy quality dirt with reasonable access to large population centers.

Therefore, larger manufacturing projects have been locating projects in smaller markets at an unprecedented rate as they can control their own real estate destiny. However, their ability to control their own destiny came with an inflated workforce risk as smaller markets lacked the critical mass of people as compared to the large Tier 1 markets.

A rapidly changing landscape

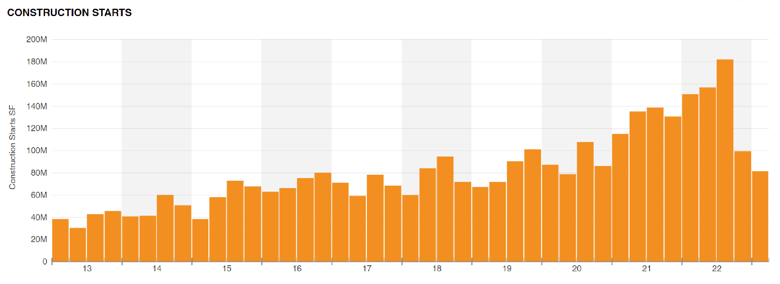

While the United States has certainly experienced a post-COVID industrial boom and while most commercial real estate analysts will tell you tenant demand is projected to remain strong, industrial construction starts have already started dropping.

Source: Costar

Many institutional developers will attest to several headwinds that are making it more difficult to make speculative deals pencil out. Further, these same headwinds are significantly raising the costs of build-to-suit deals. These factors include overbuilding by some in the e-commerce space, rising interest rates, constrained lending, bank defaults and overall financial uncertainty.

In the face of these headwinds, will institutional developers with capital tied up in large land holdings be patient enough to weather the storm? The reality is some will, and some will not. Site Selection Group is experiencing an increasing willingness from developers to consider selling part of their land holdings. This disposition of assets in these markets is an increasing opportunity for manufacturers wanting to control their real estate destiny.

The most active markets for industrial development equals potential site selection opportunity

When looking for markets with a surplus of developer-controlled sites, it is likely good to start with those that have experienced the most speculative construction starts. The following table shows the top 20 metro areas that have the most industrial space under construction (Q2 2023).

Rank |

Market |

SF (000)

|

|

1

|

Dallas-Fort Worth - TX

|

60,796

|

|

2

|

Phoenix - AZ

|

52,697

|

|

3

|

Chicago - IL

|

40,948

|

|

4

|

Houston - TX

|

37,776

|

|

5

|

Inland Empire - CA

|

37,610

|

|

6

|

Atlanta - GA

|

29,854

|

|

7

|

Philadelphia - PA

|

27,679

|

|

8

|

New York - NY

|

22,802

|

|

9

|

Charlotte - NC

|

22,422

|

|

10

|

Indianapolis - IN

|

17,909

|

|

11

|

Austin - TX

|

17,469

|

|

12

|

Columbus - OH

|

15,182

|

|

13

|

Cincinnati - OH

|

11,050

|

|

14

|

Nashville - TN

|

10,808

|

|

15

|

Denver - OH

|

10,543

|

|

16

|

Kansas City - MO

|

10,369

|

|

17

|

Washington - DC

|

10,130

|

|

18

|

Orlando - FL

|

9,246

|

|

19

|

Miami - FL

|

8,846

|

|

20

|

Boston - MA

|

8,273

|