Is the Industrial Real Estate Market Turning?

by Josh Bays, on Aug 22, 2022 10:09:37 AM

Those associated with the industrial real estate industry will attest that the post-COVID-19 industrial real estate boom has been unlike anything they have ever experienced in their career, despite how long they have been in the industry. Over the course of the last 24 months, developers have constructed buildings at a record clip, vacancy has been at a historic low, and the annual rental rate escalation has never been outpaced. While this is most reflective of the warehousing and distribution industry, manufacturers have also felt the constraining effects of the real estate market.

Site Selection Group, a full-service location advisory, economic incentives, and real estate services firm, monitors critical industrial site selection data metrics to help our clients make informed location decisions. Because many of our industrial clients have been impacted by the hyper-active market, most are searching for key leading indicators that might signal a change in the marketplace that would benefit occupiers in the near future.

While SSG will argue that the earliest leading indicators are anecdotal based on working projects, some can be captured in traditional data metrics. By all accounts, CoStar does the most comprehensive job aggregating statistics and forecasting trends. SSG has highlighted some of the more pertinent data points below based on CoStar’s latest “National Industrial Report.”

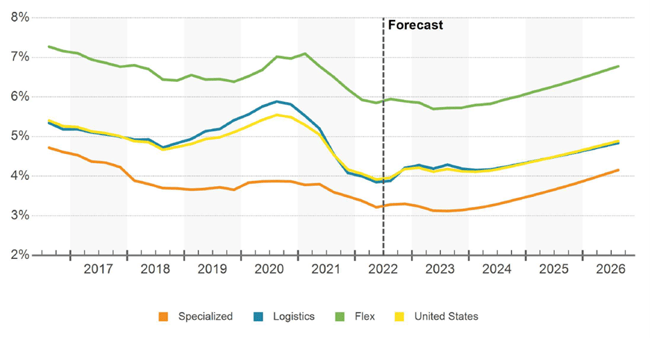

Vacancy rates may have bottomed out

It appears that national vacancy rates have bottomed out the last two quarters at just under 4% and will be rising (ever so slightly) for the foreseeable future. The chart below shows the expected modest rise in vacancy rates over the next five years.

Source: CoStar

Source: CoStar

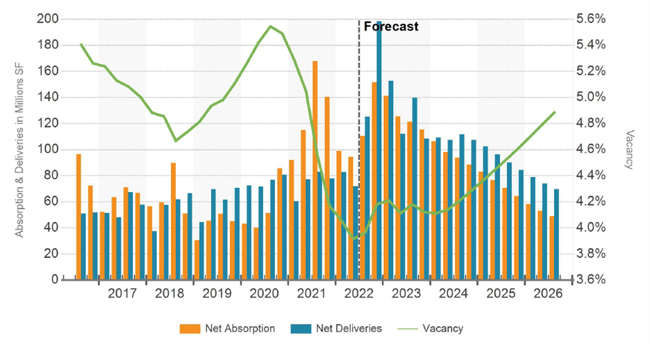

Deliveries for the next five years to outpace the previous five

While there is some trepidation in the overall economy due to talks (and indicators) of a recession, the data suggests the bottoming out in vacancy rates is because of the number of buildings scheduled to come online over the next five years. The chart below shows national net deliveries and how it relates to vacancy rates.

Source: Costar

Source: Costar

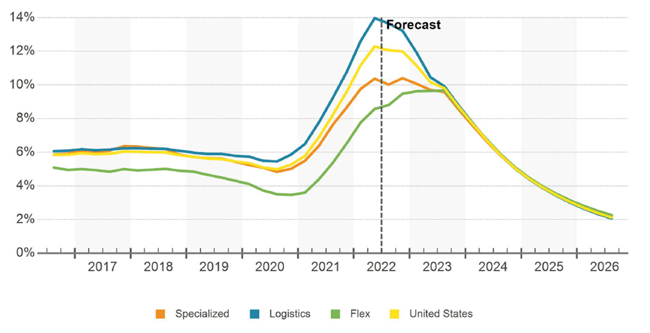

Rent growth finally peaks

The rapid escalation in rent since the pandemic had tenants wondering when a ceiling would be in sight. Based on CoStar’s latest projections, annual rent growth has peaked and will be on a sharp downhill slide, although it will not feel “normal” until late 2024 or early 2025. And despite several naysayers that have been predicting a “rent bubble,” project growth statistics do not suggest base rates will be declining.

Source: Costar

Source: Costar