How Manufacturers Should Assess Labor Availability During Site Selection

by Josh Bays, on May 15, 2018 9:25:06 AM

For manufacturers seeking to expand, relocate or consolidate their production footprint, the availability of a qualified workforce is typically the primary site selection driver after the company has assessed its logistics network. When choosing optimal locations for these labor and capital-intensive production operations, companies should employ a comprehensive series of workforce analyses that assess the prevalence of needed skillsets in a market, as well as the market’s ability to produce a pipeline of talent into the future.

Site Selection Group, a full-service location advisory, economic incentives and real estate services firm, provides its corporate clients a full suite of workforce analytics for the purposes of mitigating hiring challenges. Based on our recent experience, it is more critical now than ever for companies to invest heavily in workforce analytics during the site selection process.

As production rises, manufacturers stretched to find qualified workers

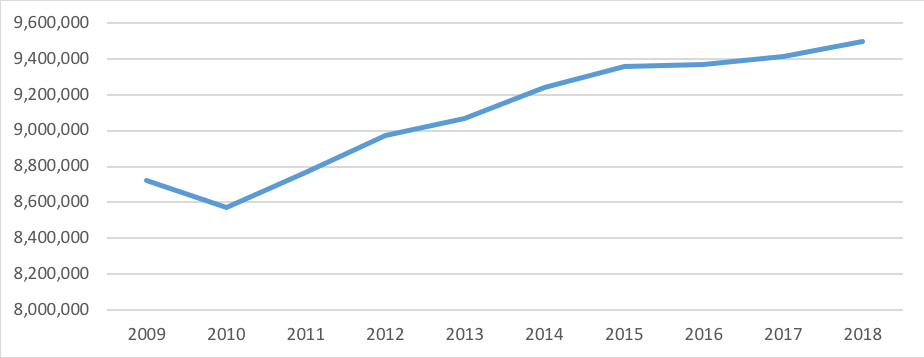

The United States is currently experiencing the perfect storm as it relates to the tightening of the production workforce. Although there are a variety of factors that contribute to this inconvenience to domestic manufacturers, the issue can simply be explained as the demand for production skillsets in most markets has reached or exceeded the supply of readily available workers. As the national manufacturing occupation data below suggests, there has been significant growth in activity since the last economic downturn.

Production Jobs

Sources: EMSI

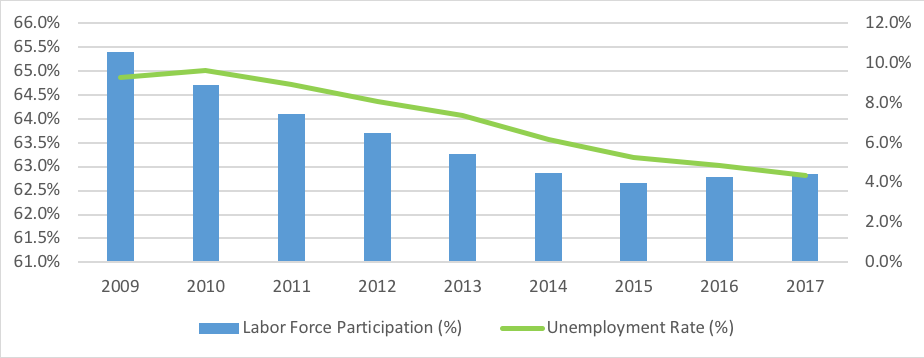

This increased production activity continues to suppress unemployment rates. Since the Great Recession, unemployment rates have dropped to less than 5% and are currently at their lowest point. However, as the workforce ages and workers retire, the labor force participation rate falls, though it has leveled off in recent years.

Workforce Trends

Sources: Bureau of Labor Statistics, Current Population Survey

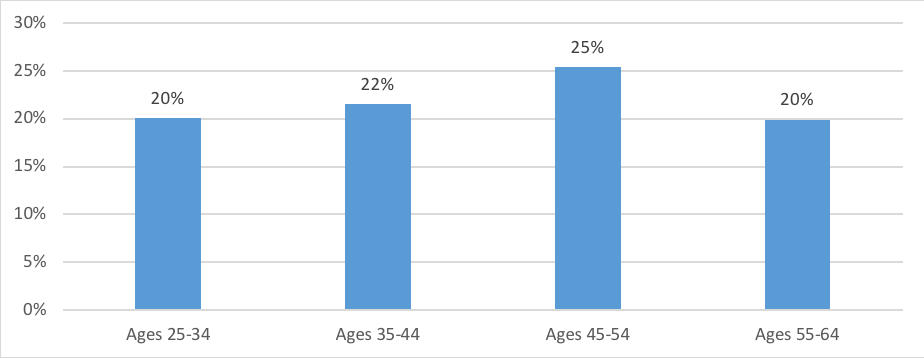

The labor market continues to tighten as manufacturing employers search to replenish their skilled production workforce. Approximately a quarter of the production workforce is aged 45 to 54 as shown in the chart below.

Age Distribution of Production Workers

Sources: EMSI

Most secondary data resources focus on the supply side of the equation

There are two types of data used when conducting workforce analytics: primary and secondary resources. Primary data sources are those that provide real-time information based on operational experience. These sources include existing employers, colleges and vocational schools, workforce development agencies, staffing agencies and the like. Although Site Selection Group believes primary data sources should be at the core of a comprehensive workforce analysis, they are difficult to leverage when filtering through a lengthy list of candidate communities. Therefore, this type of data is often used in later phases of a site selection project.

When conducting workforce analytics at a macro-level, the use of best-in-class secondary data sources becomes critical. Secondary data sources are those that aggregate data across the entire country and include entities such as the federal government and a variety of third-party data modelers. However, companies should understand the limitations associated with secondary data sources. Despite their level of quality, secondary sources typically lag 12 months which is problematic in a dynamic economy. In addition, secondary data sources are heavily focused on the workforce supply side of the equation and do little to shed light on the demand for certain skillsets.

For example, the following table is a simple illustration of supply-focused occupation statistics for machinists from secondary sources. This table shows the top metro areas ranked by number of machinists. Clearly, Chicago is home to many machinists as demonstrated in this table. However, this data set serves as a poor indicator to assess the hiring pressures in the market.

Metro Areas by Total Number of Machinists

| Metro Area | Total Machinists | Labor Force | Machinists % of LF |

|---|---|---|---|

| Chicago-Naperville-Elgin, IL-IN-WI | 24,976 | 5,058,996 | 0.49% |

| Los Angeles-Long Beach-Anaheim, CA | 17,218 | 6,951,258 | 0.25% |

| Houston-The Woodlands-Sugar Land, TX | 10,029 | 3,570,567 | 0.28% |

| Detroit-Warren-Dearborn, MI | 12,395 | 2,146,574 | 0.58% |

| Minneapolis-St. Paul-Bloomington, MN-WI | 8,500 | 2,046,571 | 0.42% |

| New York-Newark-Jersey City, NY-NJ-PA | 7,694 | 10,561,482 | 0.07% |

| Dallas-Fort Worth-Arlington, TX | 6,986 | 3,907,775 | 0.18% |

| Seattle-Tacoma-Bellevue, WA | 6,497 | 2,115,400 | 0.31% |

| Milwaukee-Waukesha-West Allis, WI | 5,797 | 837,537 | 0.69% |

| Cleveland-Elyria, OH | 5,942 | 1,063,441 | 0.56% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 5,463 | 3,203,071 | 0.17% |

| Boston-Cambridge-Newton, MA-NH | 5,402 | 2,747,261 | 0.20% |

| Cincinnati, OH-KY-IN | 4,894 | 1,131,547 | 0.43% |

| Phoenix-Mesa-Scottsdale, AZ | 4,707 | 2,315,492 | 0.20% |

| Pittsburgh, PA | 3,979 | 1,215,124 | 0.33% |

| Greenville-Anderson-Mauldin, SC | 4,647 | 436,093 | 1.07% |

| Hartford-West Hartford-East Hartford, CT | 3,818 | 663,174 | 0.58% |

| St. Louis, MO-IL | 3,655 | 1,483,091 | 0.25% |

| Charlotte-Concord-Gastonia, NC-SC | 3,659 | 1,339,032 | 0.27% |

| San Diego-Carlsbad, CA | 3,616 | 1,754,743 | 0.21% |

Sources: EMSI,MSAs with at least 500 machinists

Using job postings data to assess the demand for certain skillsets

Site Selection Group employs a balanced approach with regard to workforce analytics in order to better assess both supply and demand. One of the few secondary data sources available for assessing the demand for skillsets in a market is job postings data. When comparing job postings in a market to the number of people employed in a specific occupation, one can get a sense of the hiring pressures that exist in a market. The following table shows the top 10 metro areas with the highest job posting activity for machinists relative to the total number of machinists employed. The higher the proportion, the more competitive a market is for the machinist skillset.