Evaluating the Impact of Financial Market Trends on Site Selection

by King White, on Aug 8, 2024 2:00:00 PM

Recent shifts in financial markets, triggered by the July jobs report and a mix of corporate earnings, have raised questions about the potential impact on site selection project activity. Site Selection Group has analyzed these market conditions to provide insights into the future trends in office, industrial, and data center site selection.

Office site selection: Signs of bottoming out

Office-related site selection activity, encompassing headquarters, software development, call centers, and shared service centers, was already showing signs of bottoming out, with office market vacancies at approximately 20% — equating to 1 billion square feet available for lease or sublease. Despite the recent financial upheavals, it's unlikely that the situation for office site selection will worsen. There is speculation that this sector may have reached its lowest point, with potential for recovery anticipated in the latter half of 2025, possibly spurred by return-to-office initiatives.

Industrial site selection: Diverging paths

The industrial sector, particularly in warehousing and manufacturing, has previously seen robust activity. Nonetheless, the landscape is shifting:

- Warehousing: The stabilizing of supply chains and the realization of overbuilt capacities led to a decline in warehousing site selection activity by late 2023, resulting in an oversupply in the warehouse real estate in most markets.

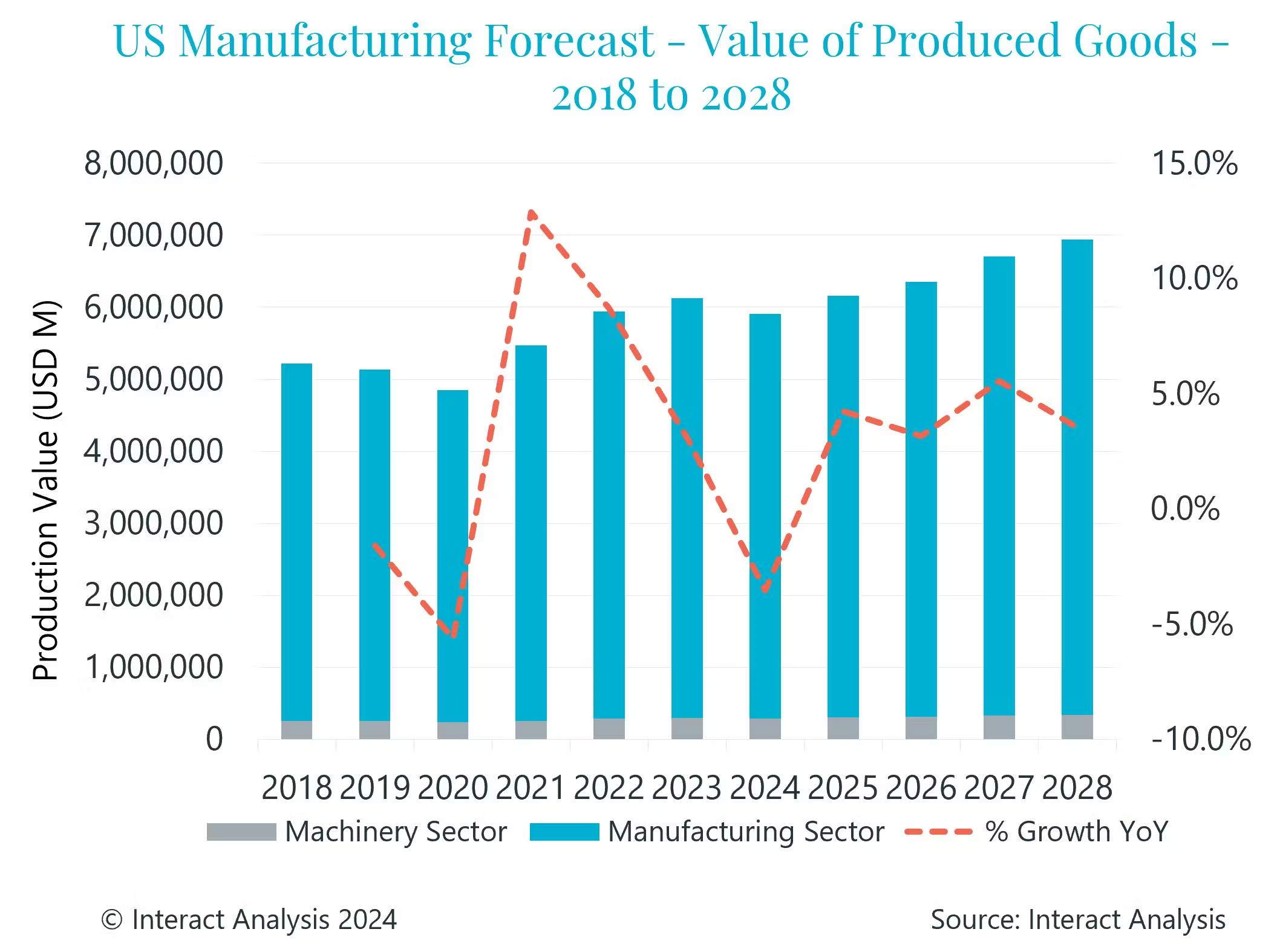

- Manufacturing: While manufacturing site selection remains vigorous, indicators suggest a potential slowdown, signaling a cautious approach for future investments in this sector. The following graph shows slowing manufacturing conditions.

Data center site selection: Continued growth amid bubble speculation

Unlike other sectors, data center site selection activity continues to surge, driven by escalating demands for AI-related data processing capacities. Despite concerns over a possible bubble in the AI sector, current trends indicate sustained growth in data center projects, highlighting the sector's resilience to broader market fluctuations.

Employment trends and their impact on site selection

Recent labor market data has shown a softening, which could influence site selection strategies:

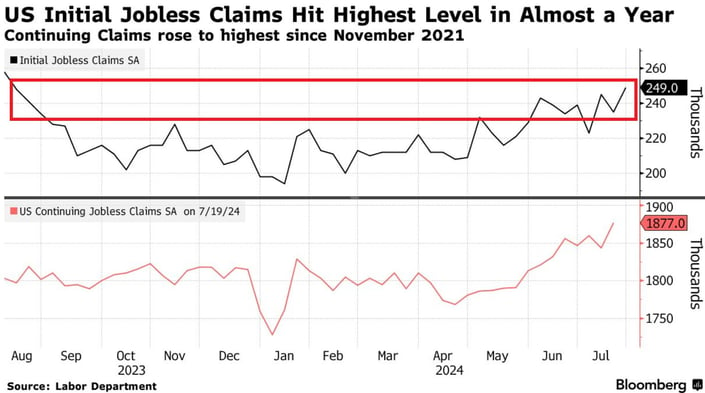

- Unemployment figures: The August jobs report indicated a slowdown with only 114,000 jobs added—significantly below the expected 175,000. The rise in unemployment to 4.3%, the highest since October 2021, suggests a cooling labor market, which may affect site selection decisions.

- Unemployment claims: An uptick in new claims to 249,000 and continuing claims reaching approximately 1.9 million reflects increased layoffs. This softer labor market could benefit employers involved in new site selections, providing a broader pool of available talent.

Outlook for site selection activity

Looking ahead, site selection activity will likely moderate through the remainder of 2024, with the potential for a rebound in 2025. Factors that could influence a recovery include anticipated reductions in Federal interest rates, post-election stability, and easing stock market volatility. Current market conditions present opportunities for companies to initiate site selection projects, taking advantage of more favorable labor market conditions and economic development organizations looking to bring projects to their communities.

Conclusion

As we navigate these turbulent times, understanding the interplay between market conditions and site selection activity is crucial for businesses planning their real estate and operational strategies. Site Selection Group remains committed to providing timely, data-driven insights to aid our clients in making informed decisions in this dynamic landscape.