Three Critical Industrial Site Selection Themes for 2024

by Josh Bays, on Jan 15, 2024 8:00:00 AM

Most reputable industry sources seem to agree that domestic manufacturing activity and investment in 2024 will remain strong. This narrative is consistent with our conversations with industrial clients and prospects.

While activity in bulk distribution seemed to have peaked in early 2023 and warehousing projects slowed a bit, there are several reasons the U.S. remains a viable target for manufacturing. The most notable drives seem to be federal programs (IRA, CHIPs, etc.), de-risking of international supply chains, and consumers’ strong desire for domestic products.

Site Selection Group, a leading full-service location advisory, economic incentives, and real estate services firm, monitors industrial site selection trends to help clients mitigate potential challenges. While a variety of site selection drivers influence location decisions, Site Selection Group anticipates the following three themes to be prevalent in 2024:

- The inventory of quality industrial sites will vary greatly based on a project’s requirements.

- The competition for existing industrial buildings will be at the lowest point since 2020, likely lower than ’25 and ’26 will be.

- Despite significant investments across the U.S. in electric generation and transmission, as well as municipal utility systems (water and wastewater), large industrial projects will still face capacity challenges and lengthy equipment lead times.

Detailed commentary on each of these three themes follows.

Inventory of quality industrial sites will vary greatly based on a project’s requirements

Due to hyperactivity in the manufacturing and distribution sectors over the last several years, the market for quality industrial sites has become severely constrained. A quality industrial site typically has adequate utility and transportation infrastructure adjacent to the property and is without material development impediments such as environmental, sub-surface, wetland, or topographical issues.

For simplicity, sites can be categorized into three classifications based on size, utility capacities, and modes of transportation infrastructure:

- Large-scale manufacturing projects: 500+ acres; exorbitant utility requirements; industrial road and rail connectivity (sometimes referred to as “mega” sites)

- Mid-size manufacturing projects: 100 to 500 acres; moderate utility requirements; industrial road connectivity

- Light industrial (including standard warehousing) projects: 100> acres; benign utility requirements; industrial road connectivity

The inventory for sites accommodating large-scale manufacturing projects will likely remain constrained throughout 2024. The hyperactivity mentioned above in industries such as electric vehicles, semiconductors, clean energy, and metals has severely depleted the inventory of quality megasites. Most (not all) of what is left would require lengthy and costly improvements for a large-scale user to become operational.

However, there could be relief beyond 2024. States, electric utilities, and rail providers are investing significant resources in proactive product development. While these are long-term propositions, billions of dollars are dedicated to new site identification, infrastructure extensions, and capacity upgrades.

The outlook for sites accommodating mid-size manufacturing projects is similar to large-scale projects. The inventory of sites increases significantly if rail connectivity is not a rigid project requirement.

Over the last several years, the bulk of light industrial activity has been general warehousing in and on the periphery of sizeable metro areas. Because of this, there has been a rapid “land grab” during this time by institutional developers in these regions. Traditionally, most of these sites were held for speculative development and/or controlled build-to-suit projects. However, due to a slowdown in activity, rising interest rates, and the political uncertainty of an election year, developers are shifting their outlook a bit. This shifting outlook has some developers more willing to sell land sites outright than at any point in the last few years.

The 2024 competition for existing industrial buildings will be at the lowest point since 2020

The industrial building market in the United States is driven by the warehousing industry. Because quality second-generation production plants were few and far between in the three years following the pandemic (and will remain scarce for quite some time), the overwhelming majority of product on the market have been newer vintage warehouses, most of which were speculative developments.

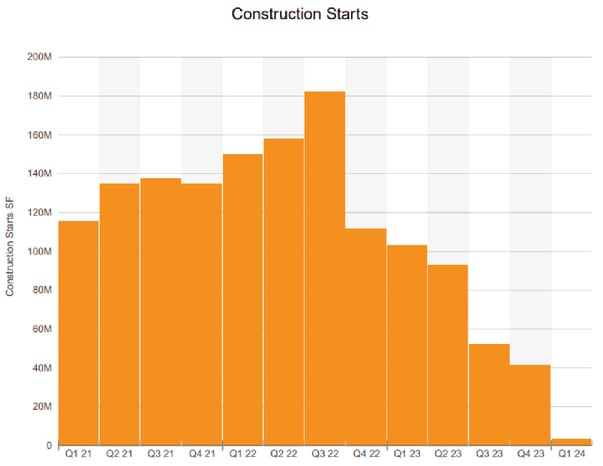

During these three years, it seemed as if developers were constructing buildings as quickly as possible, and many were getting leased before construction neared completion. The following chart tracks industrial construction starts by quarter in the United States, per CoStar. From its peak in Q3 ’22, construction starts have tapered off due to rising interest rates, existing building supply, and a slight slowing of warehousing demand. There is a noticeable dip projected for Q1 ’24.

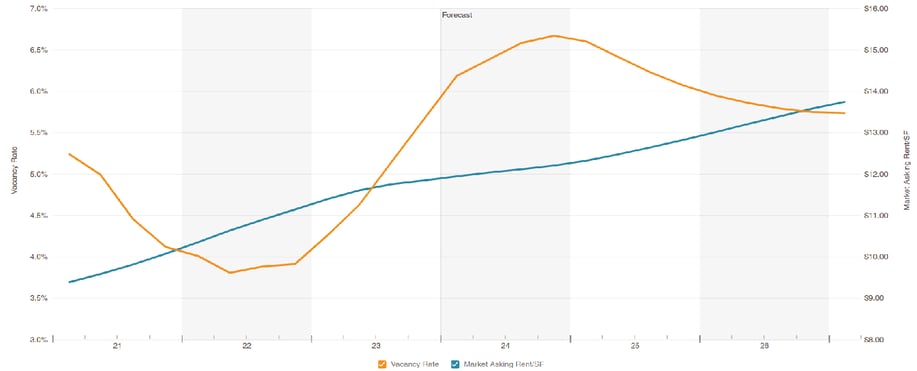

The following chart shows historic and projected vacancy rates from 2021-2026, per CoStar. Since the end of ’22, vacancy rates have risen and are expected to peak in Q4 ’24.

So, what does this all mean for industrial occupiers? Because of the recent construction boom coupled with a slight slow in demand, there will be more product on the market in 2024 than at any point in the last several years. And since high-interest rates and uncertainty will keep speculative development slowed, it’s unlikely that there will be much product coming on the market during the backside of 2024. Site Selection Group anticipates 2024 to be a “sweet spot” for those in the market for a modern warehousing facility. As the projected rent curve in the chart above suggests, we don’t expect much rent relief, but we are seeing quite a bit more flexibility from landlords on material deal terms.

Large industrial projects will still face capacity challenges and lengthy equipment lead times

The utility profile for manufacturing projects has grown significantly during this domestic manufacturing renaissance. There was a time in the not-too-distant past when a project requiring 30 MW of electricity was considered sizable. Currently, projects requiring 100+ MW of electricity and exorbitant water, wastewater, and natural gas capacities are not uncommon.

Not only have large-scale industrial sites become constrained in this current market, but utility systems across the country have been cannibalized. Power companies have been investing billions in generation capacity (and converting to green generation) and transmission capacity. Despite these investments, relief will not be here anytime soon. Lead times on transformers and other critical electrical equipment can range from 24 to 30 months.

Additionally, municipal utilities (water and wastewater) have been taxed by the influx of industrial uses at the same time many are trying to deal with population growth and increasing development. Although some regions of the U.S. struggle with water resources, the availability of water typically is not the bottleneck to industrial site selection. Over-taxed wastewater systems typically require very costly and lengthy upgrades and can be complicated by local politics. This phenomenon pushes large industrial projects to explore water treatment, recycling, and reuse on-site.

Despite the challenges and risks, there are quality location solutions out there for everyone

Yes, the site selection process has become as nuanced and complicated as ever, but if employed correctly, it can yield favorable location solutions. For example, there are a variety of technology platforms that have modernized analytics around workforce, sites, developability, infrastructure, utilities, etc. Additionally, the industry is doing a much better job of proactively identifying sites that might be unknown in economic development circles.

Site Selection Group firmly believes that understanding current market trends helps to calibrate the process and site selection tools used to mitigate risk and challenges.