Site Selection & Economic Trends: Impacts on Food & Beverage

by Josh Bays, on Jun 14, 2023 9:30:00 AM

The food & beverage manufacturing sector is thought to be one of the most resilient sectors as it relates to industrial site selection. Despite economic headwinds and market uncertainty, food & beverage manufacturing activity has remained strong over the past six months. Site Selection Group, a full-service location advisory, economic incentives and real estate services firm monitors industry activity using multiple sources.

According to fDi Intelligence, the food & beverage sector has publicly announced 86 manufacturing and/or distribution projects within the first half of 2023. This activity represents the creation of 6,848 jobs and a total capital investment of $4.3 billion.

Based on Site Selection Group’s very recent experience, site selection activity in this sector is being driven by several factors, but most notably new and innovative products reaching commercial scale, as well as the need for companies to get closer to the consumer with more organic and fewer shelf-stable products.

Top factors influencing site selection decisions for food & beverage projects

While every food & beverage site selection project is driven by a set of criteria unique to that company, several broad themes have emerged. The following list summarizes the typical site selection drivers, as well as the current market outlook for each.

- Logistic efficiencies – As mentioned, food & beverage companies typically face the challenge of getting closer to their customer for the purpose of reducing transportation costs, but also to shorten the time in transit for less-stable products. Currently, there is tremendous activity on the periphery of large population centers across the United States.

- Workforce development strategies – Workforce shortages and challenges likely represent the biggest risk to manufacturing in the United States. While companies are using a variety of data points to assess labor availability and quality, they are also placing a renewed emphasis on the workforce development & training ecosystem that can help them develop a long-term pipeline of talent.

- Speed-to-market & developability – While the food & beverage industry doesn’t feel the timing pressure associated with expiring federal incentives the way the semiconductor or electric vehicle sectors do, getting projects completed quickly is important. The best way to expedite the site selection process is through “ready-to-go” real estate options that have the required utilities & infrastructure and short development timelines to allow the easiest path to operations.

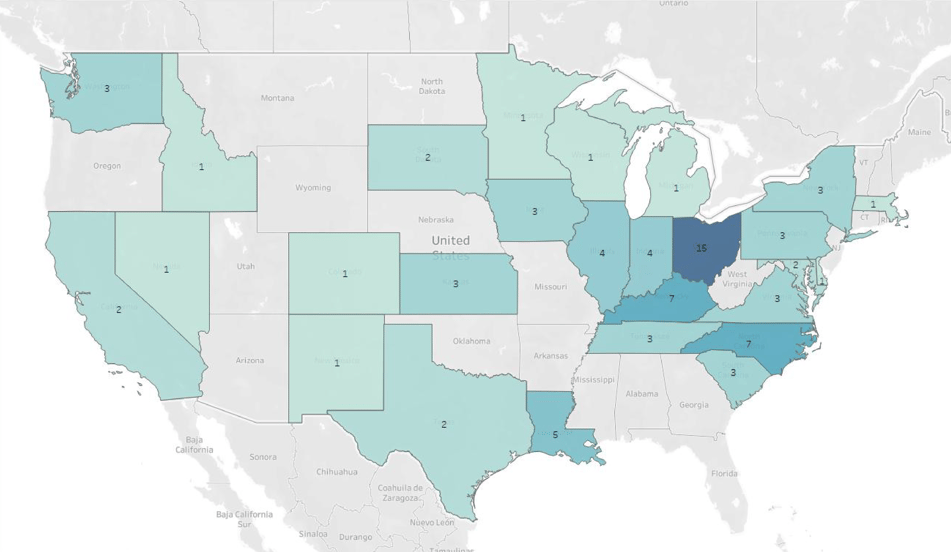

Geographic site selection trends for food & beverage projects

The following map (shaded by number of projects) shows food & beverage manufacturing and/or distribution announcements for the last six months. While there is healthy activity in a variety of regions, there are several geographic themes worth noting. While every food & beverage site selection project is driven by a set of criteria unique to that company, several broad themes have emerged. The following list summarizes the typical site selection drivers, as well as the current market outlook for each.

- The Midwest leads the nation in announcements – the activity in Ohio, Indiana and Kentucky is likely driven by access to the U.S. consumer base as well as good access to feedstock.

- The Southeast remains a popular location option – like other industries investing billions in the Southeast, the food & beverage sector is taking advantage of friendly business environments and access to critical infrastructure.

Top economic incentive packages for food & beverage projects

While operational factors such as logistics, workforce and speed-to-market typically drive site selection early in the process, economic incentives can often be a very meaningful differentiation between candidate locations. Using IncentivesFlow, Site Selection Group tracks meaningful economic incentive packages in the food & beverage industry. The following table summarizes the more impressive economic incentive packages awarded in the industry.

Company |

State |

Capital Investment ($M) |

Job Creation |

Incentive Amount ($M) |

| James Richardson & Sons | TN | $220 | Not Disclosed | $36.00 |

| Wholestone Farms | SD | $500 | 950 | $25.00 |

| Nestle | IN | $460 | 68 | $12.00 |

| International Food Solutions | OH | Not Disclosed | 225 | $9.60 |

| Premium Brands | TN | $205 | 840 | $9.00 |

| Hilmar Cheese Company | KS | $550 | 247 | $7.90 |

| Sazerac Company | IN | $78 | 50 | $5.90 |

| Mary Anns Baking | CA | Not Disclosed | 105 | $5.00 |

| Bottomland Prime | TX | Not Disclosed | 12 | $4.90 |

| Redstone Dairy | SD | Not Disclosed | 80 | $4.40 |

There are a variety of programs at the state, local and utility level to incentivize food & beverage projects. Additionally, economic incentive aggressiveness can differ greatly by region. The following represents the most common types of incentives currently being leveraged by companies:

- Property tax assistance – Whether it comes in the form of property tax abatements, refunds or payment in lieu, offsetting property taxes can be a meaningful incentive for these large capital investment projects.

- Infrastructure & development assistance – The most popular mechanism to offset upfront capital investment is assistance aimed at infrastructure and or civil development costs.

- Job creation cash grants – While the most coveted by companies, upfront cash assistance is becoming less popular among states and communities. However, several states still offer closing fund assistance based on job creation and payroll.

Five key food & beverage site selection projects of interest

While subjective to a degree, Site Selection Group has identified the following as projects of interest. Typically, projects of interest are determined by a combination of factors including location, size of project, type of products and economic incentive packages.

- Hilmar Cheese Company (Dodge City, Kansas) – Investing $550 million and creating 247 new jobs at its new cheese and whey processing facility.

- Michael Foods (Des Moines, Iowa) – Investing $146 million and creating 187 jobs at its new egg production and processing center.

- Believer Meats (Wilson, North Carolina) – Investing $123 million and creating 100 new jobs at its new cultivated meat production plant.

- Carnivore Meat Company (Green Bay, Wisconsin) – Investing $74 million and creating 158 jobs at their new pet food facility.

- Pernod Ricard (Lebanon, Kentucky) – Investing $196 million and creating 55 jobs at its newest distillery and warehousing operation.

Food & beverage site selection outlook for the next 6 months

Despite headwinds such as inflation, project financing hardships and political uncertainty heading into an election, Site Selection Group expects the food & beverage industry to maintain its momentum. But given market activity and the fierce competition for resources, it’s more important than ever for food & beverage companies to employ an objective and rigorous framework to their location decisions.