Distribution Center Site Selection Trends from the First Half of 2020

by Josh Bays, on Jul 22, 2020 10:59:51 AM

Site Selection Group, a leading location advisory and economic incentives firm, researched site selection trends for distribution center projects announced in the first half of 2020. According to Conway Analytics, the number of announced distribution center projects from the first half of 2020 is roughly the same as the same period in 2019. In addition, average job creation and capital investment per project has increased. At 239 employees, the average number of jobs created per project was up 5% from 2019. Capital investment increased from an average of approximately $35 million to $51 million.

Comparing 2020 with 2019

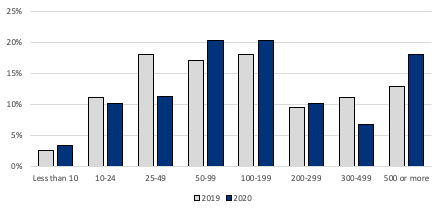

Though the number of project announcements remained the same, on average, projects in 2020 trended toward creating more jobs, with roughly 25% of announced projects creating 300 or more jobs.

Distribution Project Announcements by Job Creation

Source: Conway Analytics

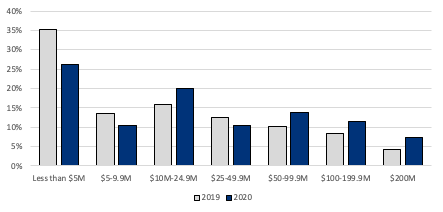

Similarly, projects announced in the first half of 2020 tended to invest more capital than projects in the first half of 2019 (though roughly a quarter of projects still invested less than $5 million).

Distribution Project Announcements by Capital Investment

Source: Conway Analytics

Metros with high distribution center project announcements and growth

Site Selection Group identified 10 metros areas with high activity of distribution center projects thus far in 2020.

| Metro Area | Projects Announced |

|---|---|

| Chicago-Naperville-Elgin, IL-IN-WI | 19 |

| New York-Newark-Jersey City, NY-NJ-PA | 11 |

| Dallas-Fort Worth-Arlington, TX | 9 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 9 |

| Miami-Fort Lauderdale-Pompano Beach, FL | 8 |

| Charlotte-Concord-Gastonia, NC-SC | 6 |

| Denver-Aurora-Lakewood, CO | 6 |

| Atlanta-Sandy Springs-Alpharetta, GA | 5 |

| Boston-Cambridge-Newton, MA-NH | 5 |

| Houston-The Woodlands-Sugar Land, TX | 4 |