Constrained Water Resources & Impacts on Industrial Site Selection

by Michaela Martin, on Apr 25, 2023 7:45:18 AM

As those in the economic development and site selection industry will attest, the volume of mega projects investing in the United States has grown exponentially over the last few years. The catalyst for this increased investment is multifaceted and has had a profound impact on the growth of key sectors such as electric vehicles, semiconductors and clean energy. With the significant rise in the volume of mega projects comes a significant demand for utility resources which are more constrained every day.

While initially, many focus on the role electricity plays in site selection for mega industrial projects (and rightfully so), businesses may lose focus on the importance of other key utilizes. Of those constrained utilities — water resources — and the competition for such resources is intensifying across the country.

Site Selection Group, a full-service location advisory, economic incentives and real estate services firm, proactively monitors water resource trends across the United States to understand how these trends will impact our clients’ projects.

Water sourcing methods vary across the US

Whether our clients are producers of food & beverage, electric vehicles and battery components, solar components, or chemicals, water can be used for various reasons such as input into the product, cooling, washing or sanitation. Further, projects can require a variety of water types:

- Potable water: The water of municipal systems meant for human consumption

- Purified water: Potable water treated to higher standards to remove impurities such as chemical compounds, minerals and biological contaminates

- Non-potable water: Non-drinkable water that typically comes from raw, untreated water sources such as lakes, rivers, groundwater, recycled or reclaimed wastewater

- Greywater/recycled/reclaimed water: Collected and reused non-potable water

Before launching into a site selection effort, companies should understand a project’s water profile so that potential sites can be adequately qualified based on the capacity of the water sources noted above. For example, if a large project uses water simply for cooling and does not require potable water, they could potentially consider water sources that are less constraining (ie – greywater). In a market where municipal water systems are constrained, using this strategy can unlock more sites.

Water rich vs. water restrictive

In the world of industrial site selection, communities and states often fall into the category of being ‘water rich’ or ‘water restrictive.’

'Water rich' often indicates the overall water quantity available by surface water and groundwater resources, often measured by the abundance of precipitation, groundwater levels, streamflow and reservoir levels.

States like New York and Virginia have historically been considered water-rich states. New York enjoys abundant water from the Finger Lakes, the Great Lakes and approximately 53,000 miles of streams and rivers. and Virginia, meanwhile, contains over 100,000 miles of streams and rivers, millions of acres of freshwater and coastal wetlands, and 248 public lakes.

'Water restrictive' often indicates severe droughts, declining reservoir levels, depleted aquifers, reduced snowpack and rising temperatures, which all play a role in water restrictions.

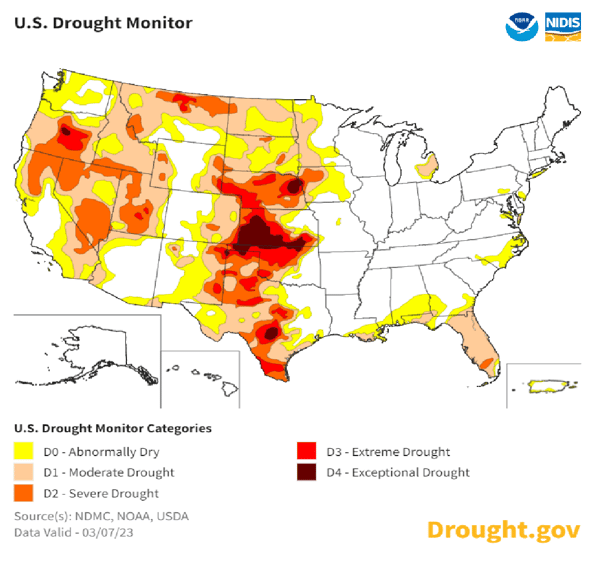

Given the state of the Colorado River Basin, many western states are addressing their water availability and setting goals to ensure water remains accessible for both residential, agricultural and industrial users. The map below shows areas of the United States impacted by drought that could cause increased stress on water resources.

State-level water resource management

States are taking aggressive measures to manage water resources. Arizona is one such state pushing the envelope to ensure water supply with five times more water stored than used. Arizona established the Groundwater Management Act of 1980 — noted as one of the 10 most innovative programs by state and local governments by the Ford Foundation in 1986. One requirement of the program is that any new development in most urban areas must demonstrate a 100-year-assured water supply. This water supply requirement forces industrial developers to provide long-term planning solutions for current and future growth. Arizona’s population has grown nearly 500% since 1957, yet; Arizona uses less than 7 million acre-feet of water per year — 3% less than what users consumed almost 60 years ago, according to the Arizona Department of Water Resources.

Using water as a recruiting tool

In 2020, South Carolina conducted a statewide public water and wastewater study to identify locations within the state that may have large or untapped water and/or wastewater capacity. The purpose of the study, performed by the SC Power Team, was to evaluate public water and wastewater service providers with an excess available capacity greater than 2.5 million gallons per day (MGD). The study identified 20 locations with water excess availability of 2.5 MGD and 15 locations with wastewater excess availability of 2.5 MGD.

In summary, Site Selection Group urges industrial companies to strongly profile their water needs (and factor in their environmental, social and governance initiatives before commencing the site selection process). As this precious and finite resource continues to get cannibalized, adjusting the site selection process accordingly will be imperative.